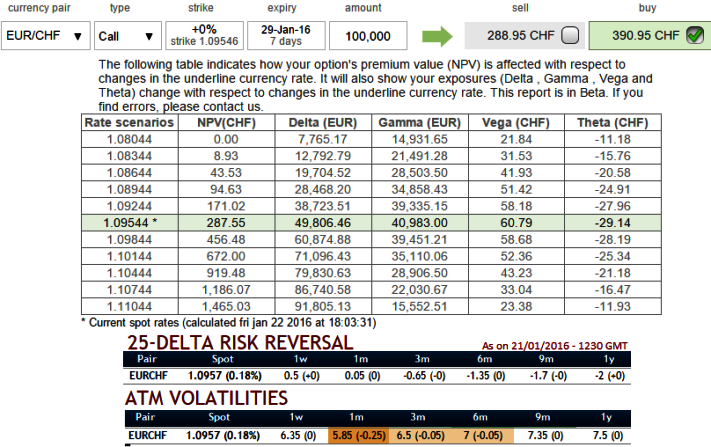

Please be noted that there is disparity between IVs and ATM premiums that are trading almost 36% more than NPV (see diagram) where as IV is at 6.35%, so hedging with these at the money instruments seems to be highly overpriced that would not be cost effective even it moves in the direction as per the anticipation as its delta amounting close to 50% would collapse as the time decay implies drastically as the IV is expected to reduce further.

For instance, suppose we've constructed an at the money put option of EURCHF with 1W expiry and with this given maturity has reduced its implied volatility from 6.4% to 5.1% and it is likely to remain on lower side (historically these vols have never disappointed), whereas ATM puts are overpriced about 40% more than NPV. So with this disparity we like to advocate below spreads and combinations so as to gain the cost advantage.

In a true smile, options with an at-the-money strike are priced with a lower volatility than out-of-the-money and in-the-money volatility strikes. Such market occurrences are observable in the EURCHF FX OTC market.

A synthetic long call is created when long stock position is combined with a long put of the same series. It is so named because the established position has the same profit potential as a long call.

In this strategy, we go long in EURCHF as we feel bullish about it. But what if the price of the pair goes down. You wish you had some insurance against the price fall. So buy a Put on the EURCHF. This gives you the right to sell the underlying pair at a certain price which is the strike price. The strike price can be the price at which you bought the spot FX (ATM strike price) or slightly below (OTM strike price).

FxWirePro: EUR/CHF OTC volume index, Risk reversals indicates short bullish hedging arrangements synthetic calls for hedging i/o naked calls

Friday, January 22, 2016 2:10 PM UTC

Editor's Picks

- Market Data

Most Popular