Technical Watch:

Euro gains almost against all majors after ECB’s monetary policy remained in line with forecasts.

The deposit rate, charged on commercial bank deposits at the ECB, remained at -0.4% and the marginal lending facility, which banks pay to borrow from the ECB, was unchanged at 0.25%.

The ECB also left its bond-buying program unchanged at €80 billion per month.

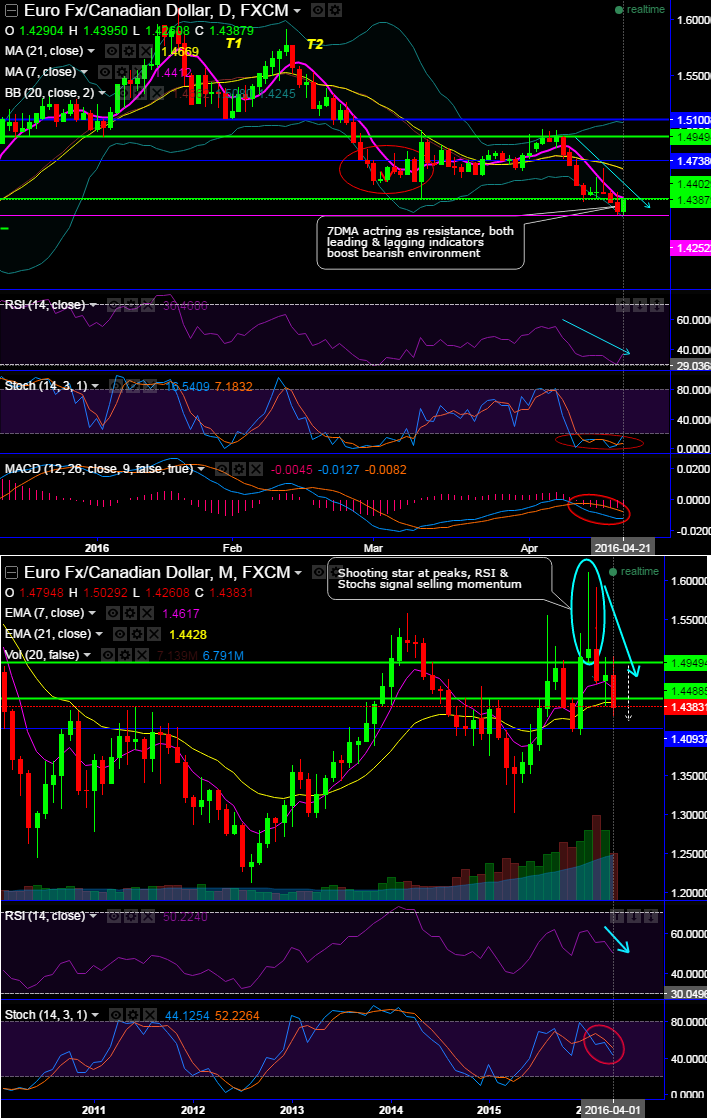

While, the stiff resistance seen in EURCAD at 1.4405, never isolating a single signal

Off-late, bear swings slipping through lower Bollinger band testing 7DMA as resistance.

The pair hasn't been able to break out above resistance at 1.4738 levels to slid below DMAs.

The current levels of 1.4374 after bouncing near support at 1.4252 levels is not substantiated by any other indicators, still remained at 4 months lows.

RSI & Stochs have been wavering to confirm these bounces taken at supports, while MACD has just shown bearish crossover below zero.

In addition to that, 21DMA has just crossed over 7DMA that is again a sell signal.

On monthly plotting, trend seems to be bearish biased ever since the formation of shooting star at 1.5127 levels with both leading oscillators (RSI & Stochastic) to converge the price dips that indicates the selling momentum.

Trade Tips:

If you're so keen or aggressive on present bounces and expects more price recoveries then below strategy is advisable.

Ideally, this is an options trading strategy that is constructed by holding underlying spot FX while simultaneously buying protective put and shorting calls against that holding.

While you're holding longs in spot FX of EURCAD, go short in 1W (1.5%) OTM striking call and long in 1W (1%) OTM striking put.

This strategy is the best suitable if you're writing covered calls to earn premiums but wish to protect himself from an unexpected sharp drop in the price of the underlying security.