- EUR/CAD has edged higher from 4-month lows at 1.4917, trades around 1.5149 at the time of writing.

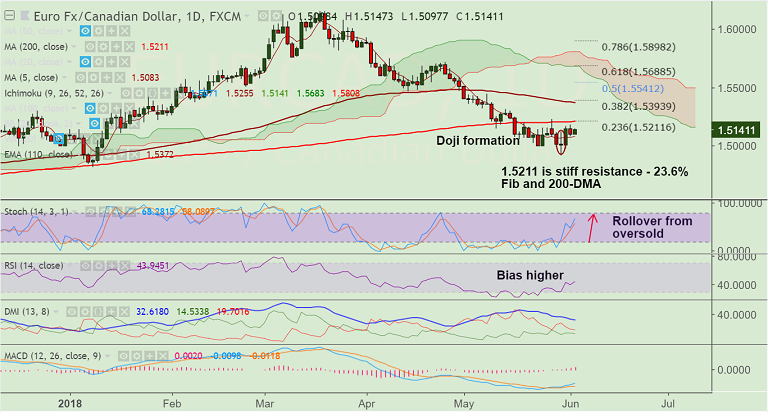

- We evidence a Doji formation at lows which raises scope for further upside.

- Price action holds above 5-DMA and technical indicators are turning bullish.

- Stochs have rolled over from oversold levels and RSI is biased higher.

- Italy's Five-Star Movement and the League finally reached a deal to form a government sending a wave of relief into stock markets.

- That said, the budget promises of Italy’s new government are set to re-shape the perceived risks associated with the euro.

- Canadian labour force survey for May (due Friday) will attract the most attention this week. Expectations are for a +15K print. Any miss on expectations could weigh on CAD.

- The major finds major resistance at 1.52112 (converged 200-DMA and 23.6% Fib). Break above could extend rallies.

- On the flipside, breach at 5-DMA support could see more downside.

Support levels - 1.5084 (5-DMA), 1.50, 1.4917 (May 30 low)

Resistance levels - 1.5211 (converged 200-DMA and 23.6% Fib), 1.53, 1.5372 (110-EMA)

Recommendation: Good to go long on breakout at 1.5211, SL: 1.5085, TP: 1.53/ 1.5370

FxWirePro Currency Strength Index: FxWirePro's Hourly EUR Spot Index was at 129.478 (Bullish), while Hourly CAD Spot Index was at -72.7821 (Neutral) at 1000 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest.