Dragonfly doji occurred at 1.4064 levels, and consequently, this bullish candle occurrence we are evidencing upswings (see monthly chart).

On the contrary, the double top with bearish EMA crossover has also formed in the rising channel that signals more weakness in this pair. On monthly – with top 1 at 1.5586 levels, top 2 at 1.6105 levels and is taking support at channel baseline.

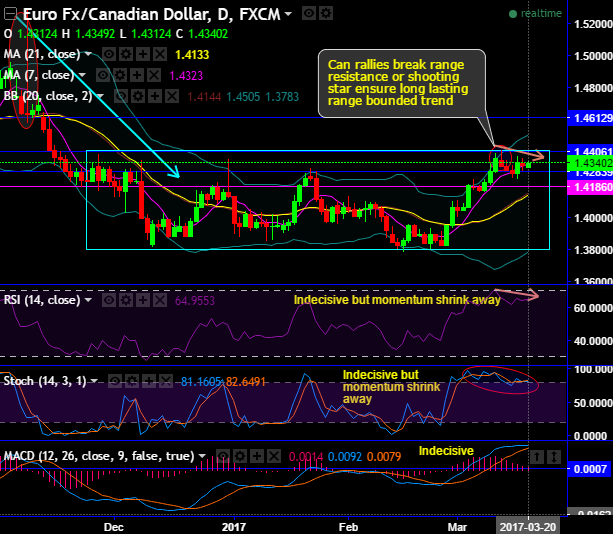

While on the daily chart, shooting star has occurred at 1.4320 level which is bearish in nature, evidently, we are seeing previous bull swings is now struggling for the momentum.

As a result, long lasting range bounded trend is now likely to prolong.

As a result of this bearish pattern the current prices have gone below DMAs and EMAs again, you could also observe bearish EMA crossover on monthly charts.

Most importantly, both leading and lagging indicators indicate weakness in this pair.

Currently, the bulls attempt to spike above 21EMA, any failure swings below this level can be conducive of the major downtrend and the retest lows of 1.4186 and 1.4134 levels can also not to be disregarded.

From prevailing selling momentum, it appears to be continuing bearish streaks as the both leading and lagging indicators are still favoring bearish environment.

This bearish stance can even be coupled with MACD's bearish crossover on monthly charts.

Trade Tips:

Well, having said that we wrap up with concluding note, short-term bulls can speculate this pair whereas long-term investors at current juncture contemplating above bearish indications, we advocate shorting futures contract of mid-month or near month expiries for target towards 1.4283, 1.4186 or even below 1.40 levels cannot be ruled out upon breach of 1st two targets.

Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.