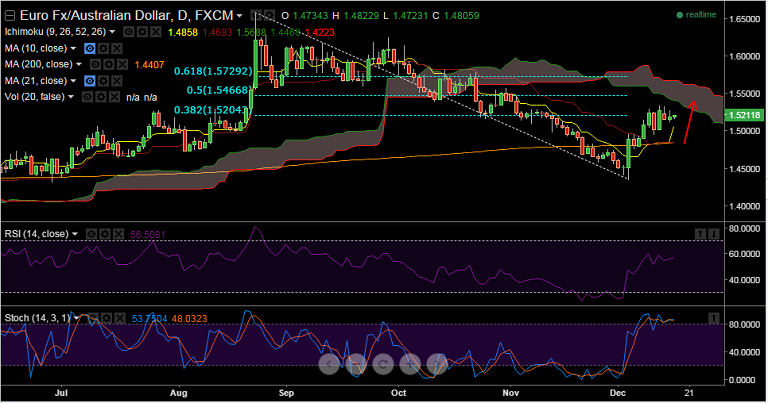

- EUR/AUD consolidating gains, next bounce to target 1.5466, 50% of August/December fall.

- Momentum studies are neutral - 5, 10 & 20 DMAs base/climb - positive setup exists, Stochs are at o/b, some unwinding likely, caution advised, RSI is at 56 and has room to run.

- Tenkan and Kijun lines which were converged yesterday now show a bullish crossover, 10 and 21 DMAs are also bullishly aligned.

- The pair is marginally higher in a low key Asian FX morning - EUR led - opened +0.2%, and is currently trading at 1.5218.

Recommendation: We would use dips around 1.5160 to go long, SL: 1.5000, TP: 1.5460

Resistance Levels:

R1: 1.5256 (Dec 10 high)

R2: 1.5276 (Dec 15 high)

R3: 1.5303 (Dec 9 high)

Support Levels:

S1: 1.5116 (Dec 15 lows)

S2: 1.5103 (Nov 6 lows)

S3: 1.5083 (10 DMA)