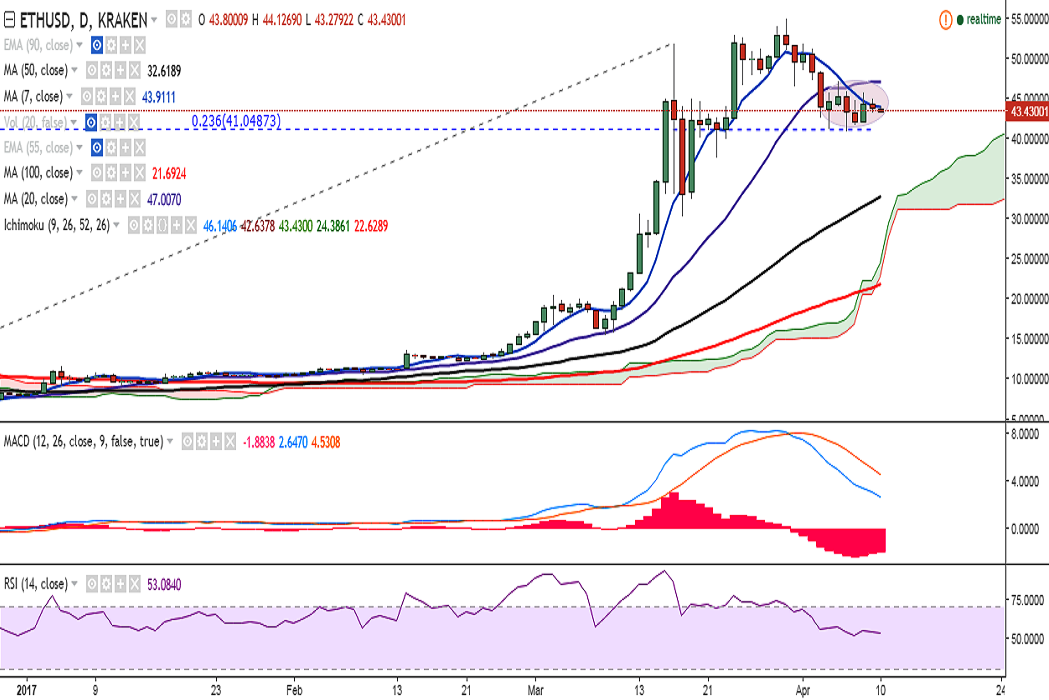

ETH/USD is largely unchanged on Monday, trading at 43 levels at the time of writing (Kraken).

Ichimoku analysis (Daily chart):

Tenkan-Sen: 46.14

Kijun-Sen: 42.63

On the upside, the pair is struggling to close above 43.94 (7-DMA) from past few days. A decisive break above would see the pair testing 45.79 (April 08 high)/47.18 (April 05 high)/ 49.64 (61.8% retracement of 54.97 and 41).

On the flipside, 23.6% retracement of 5.92 and 51.90 rally is acting as a major support for the pair (41 levels) and a break below would confirm minor bearishness in the pair, dragging it to 37.60 (March 22 low)/34.33.

Traders are advised to wait for confirmed signal on daily charts as RSI is holding above 50, while MACD and Stochs suggest bearishness in the pair.

FxWirePro: ETH/USD upside capped by 7-DMA, good to go short on break below 23.6% fib

Monday, April 10, 2017 9:56 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary