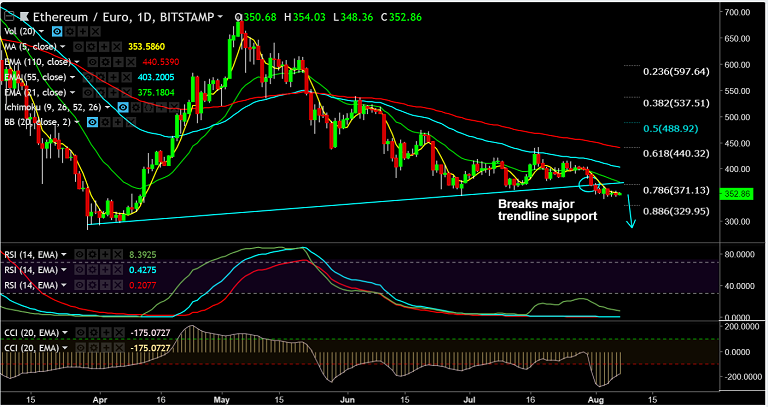

- ETH/EUR is extending sideways grind in range trade, consolidates break below major trendline support.

- The pair remains capped below immediate resistance at 5-DMA at 354 levels, bias remains bearish.

- Price action is below major EMAs. Upside has failed at 55-EMA last month and daily cloud is now strong resistance.

- The pair has broken major support at 370 level which is converged 78.6% Fib and major trendline.

- Technical indicators for near-term are bearish. RSI is below 50 and Stochs are biased lower.

- We now see scope for test of 88.6% Fib at 330 levels. Violation there could see further weakness.

- On the upside, 5-DMA at 353 is immediate resistance. Break above could see test of 21-EMA at 375 ahead of 55-EMA at 403.

Support levels - 349 (June 29 low), 330 (88.6% Fib), 283 (Mar 29 low)

Resistance levels - 370 (nearly converged trendline and 78.6% Fib), 375 (5-DMA), 403 (55-EMA), 440 (61.8% Fib)

FxWirePro Currency Strength Index: FxWirePro's Hourly EUR Spot Index was at -28.256 (Neutral) at 1045 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary