The yen held predominantly stable during Asian session today ahead of Federal Reserve review on interest rates and its own central bank review the following day.

With USD/JPY holding above the 110.00-50 pivot for now we will step back, but hold our bias for lower.

We still see risks of a squeeze higher, but prefer to wait for that to sell than be long against our medium-term view.

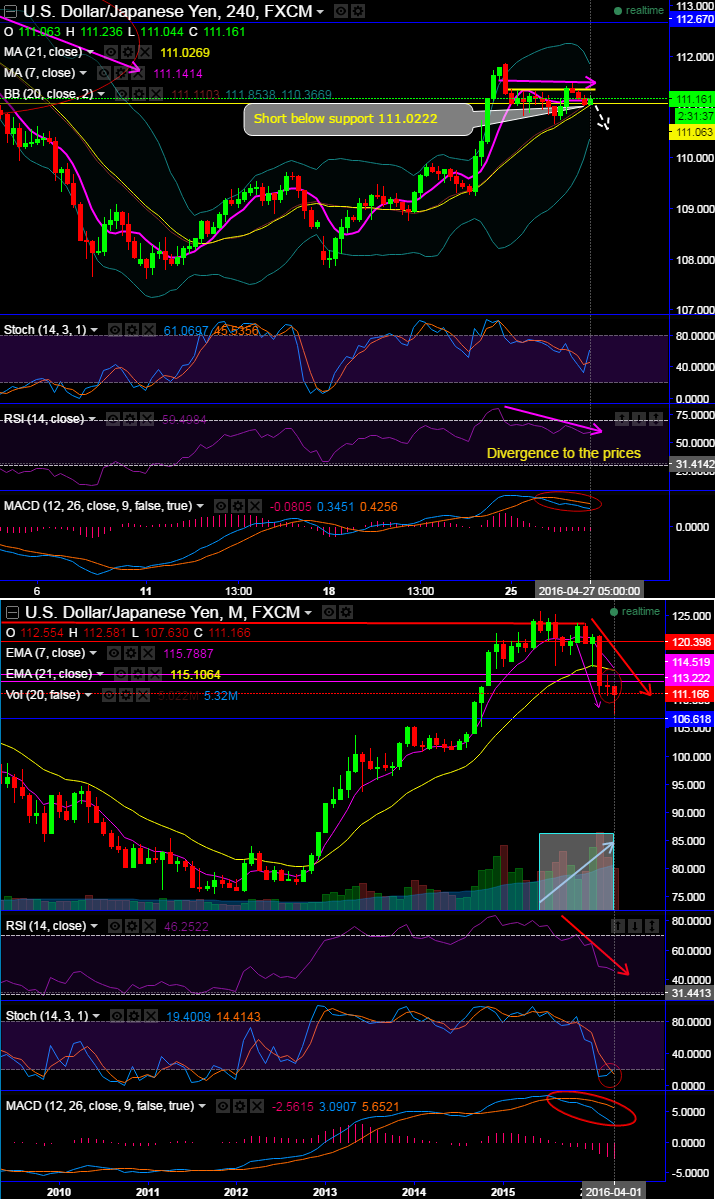

Leading oscillators on intraday (4H) and monthly charts are indicative of further declines.

RSI on 4H chart evidences divergence to the price line by forming lower lows, while the indicator converges to the monthly price dips.

%K crossover even below oversold zone on monthly plotting have not been convincing that the selling momentum is still strong.

On a broader perspectives, nothing much varied stances from short term trend but stochastic curves have approached but no trace of buying indications, while RSI is still in bears favor.

Attempts of 21DMA crossing over on 7DMA on daily and same is the case EMAs on monthly are observed, which could prop up a bearish continuation signal.

MACD although remains above zero level evidences bearish crossover.

At last, we've seen mamoth volumes which are in conformity to the bearish trend.

After two weeks of rallies, bulls seem exhausted to reject major stern resistance at 111.303 levels.

For now, we reckon if the pair breaches supports at 111.0222 levels then it can bring in more bearish sentiments to resume bear trend again.

As a result of above technical observations, bearish targets of 109.698 or 108.029 levels are quite achievable.

Trade tips:

As you can make out from the intraday charts, the pries have been in the range (111.474 and 110.670) ahead of today’s FOMC interest rate decision but every weakness in this pair would drag more below lower range.

Keeping this trend in mind we reckon, irrespective of the swings boundary binary options would fetch certain yields using the above boundaries in the binary strategy.

Alternatively, short term bears can eye on shorts in near month futures for targets of 110.232 with stiff stop loss of 111.880 levels. At spot FX reference – 111.147 trading near month futures keeping above SL and targets serves an ideal risk reward profile.