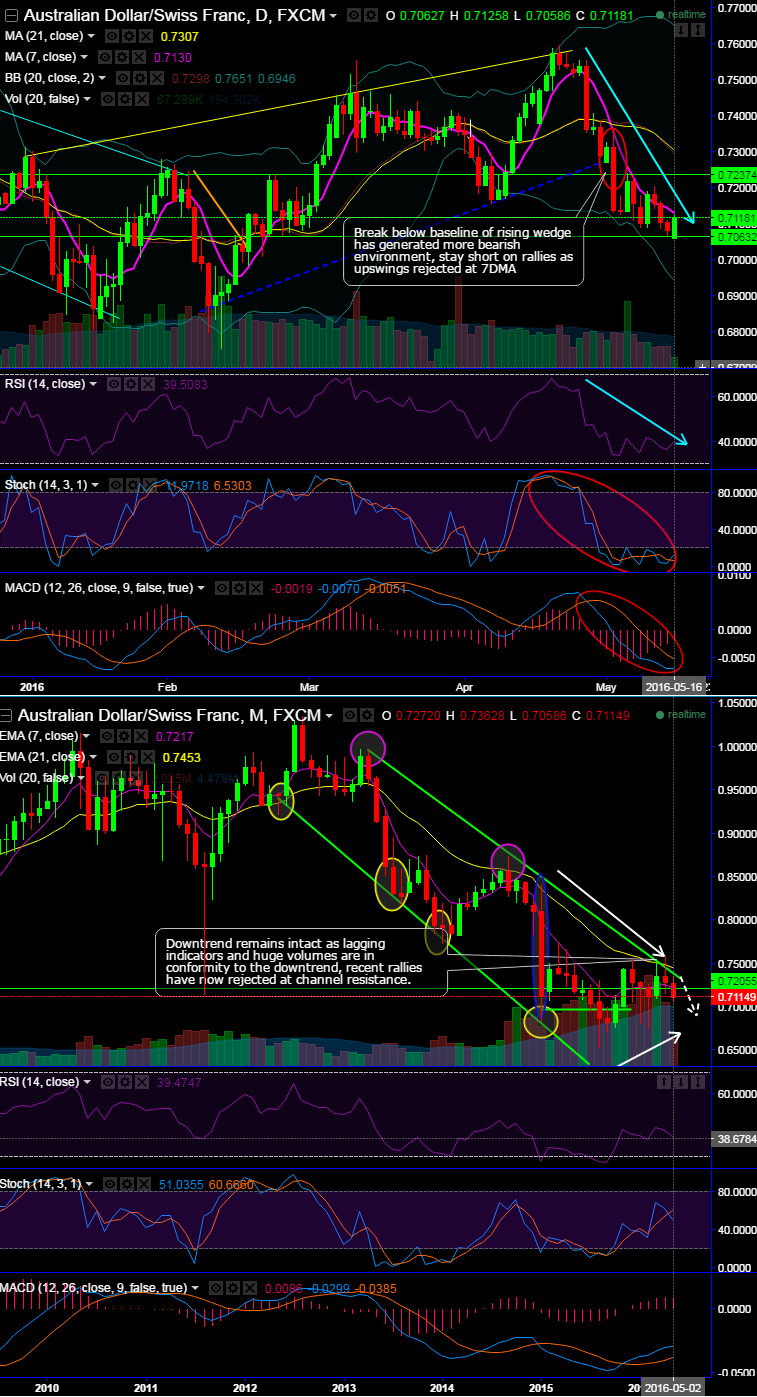

Today’s attempts of price bounces has struggled top 0.7125 levels (7DMA), it has bounced from testing supports at 0.7063 levels, but could not be able to clear 7DMA.

While, daily RSI is indicative of weakness in this pair as this leading oscillator is converging downwards considering medium term perspectives.

Stochastic curves have remained in the overbought territory, but no clues of price recoveries.

MACD is also substantiating weakness as indicates sell on daily.

Break below baseline of rising wedge has generated more bearish environment, stay short on rallies as upswings rejected at 7DMA.

Monthly Observation:

We earlier emphasized "0.7382" areas as stiff resistance of sloping channel as shown on the monthly graph.

One more notable aspect is that, the massive volumes have been generated on declining trend (see histograms on monthly charts).

Downtrend sliding in sloping channel, every now and then attempts of bounces were suppressed at channel resistance and EMA curves.

Most importantly, we advise not to get deceived by the indications generated from RSI, stochastic and MACD oscillators as you can probably guess what would happen as and when the pair approached channel resistance in past and these technical indicators stand vulnerable with bearish pressures.

Hence, contemplating the previous long term downtrend, we think this pair had taken a brief pause in last several weeks while a slight recovery took place.

Well, for now the advice for long term investors to deal to with this pair is to wait for better clarity if the pair breaches and sustains above 0.7382 levels on a closing basis, otherwise major downtrend look sturdy thus far.

But on speculation grounds, one can go short in near month futures for targets of 50-60 pips with ease, keep a strict loss of 0.7159 levels.