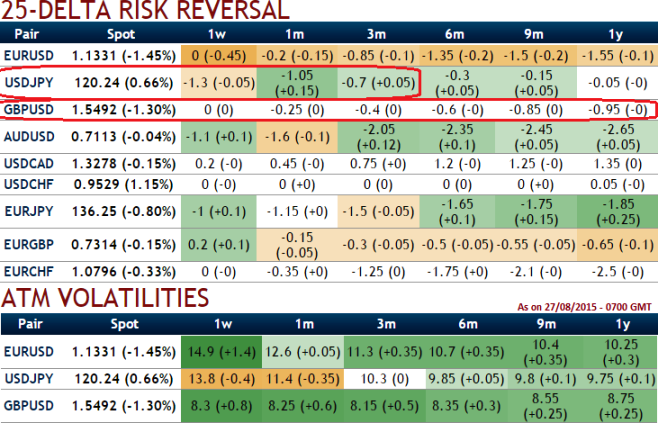

In the nutshell showing delta risk reversals of major G20 currency crosses, one can make out that cable's downside hedging for next 6-12 months has been quite expensive, and further dollar gaining against pounds would be nullified against Yen as USDJPY delta risk reversal indicates that USDJPY's downside expectations are mounting. While ATM vols of USDJPY are also comparatively higher than GBPUSD.

GBP/USD/JPY swaps as cable vols ultra cheap compared to USD/JPY vols, receive a large spread via volatility swaps.

GBP/USD volatility has limited room to increase from current levels as the market already discounts a disorderly fall and Greece issues have also been settled temporarily. US preliminary upbeat GDP numbers are flashed in highly positively at 3.7% versus forecasts at 3.2% and from previous 2.3%, while unemployment claims have also posted good set of numbers at 271K versus previous 277K.

On the flip side, the volatility spread of above two currency crosses is very wide on a historical comparison and Fed's big event is nearing in addition which can't be suppressed although rate hike rumors have been unlikely. We believe Yen's gain against dollar was majorly due to China's disruption.

Since currency swaps are motivated by competitive advantage when we you look at the volatility difference of the ATM contracts in the above nutshell, hence we recommend trading the spread on the 6M tenor. Currency swap contracts would require principal specifications in each of the two currency crosses. Such principal amounts are usually exchanged at the beginning and at the maturity of swap contracts.

FxWirePro: Dollar likely to gain vs pound but yen to snatch from dollar – a projection from delta risk reversal

Thursday, August 27, 2015 1:20 PM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary