Fundamental rationale:

Focus for this week will continue to be on the oil market and China and most importantly on the upcoming Fed decision on lift-off on Wednesday.

On the other hand, we can very much empathize with this Dollar's gains in medium run let's say for next 2 months or so considering huge FII outflows from global markets back into US.

On the contrary, a scenario with an anticipation of Fed may continue to hold on its rate or hike not as per expectation (25Bps) until Q1'16 considering global economic slowdown and US job markets would also take dollar to the new level of appreciation.

So, those who agree with this rationale and expect the USDJPY to make a large move higher, then the below strategy can be established.

It's not changing our stance, before proceeding further please refer previous article for more reading:

http://www.econotimes.com/FxWirePro-USD-JPY-likely-to-retest-122-before-14th-December-upon-multiple-bearish-signals-126774

And for current technical levels: http://www.econotimes.com/FxWirePro-Shorting-Dollar-this-week-is-absolutely-absurdity-%E2%80%93-USD-JPY-on-the-verge-of-forming-%E2%80%9CDragon-fly%E2%80%9D-targets-above-121560-130467

Kiwi dollar after continues losing streak that has begun from mid-April, it is now making an attempt of recovery a bit as both technical and fundamental indicators are signaling buying sentiments.

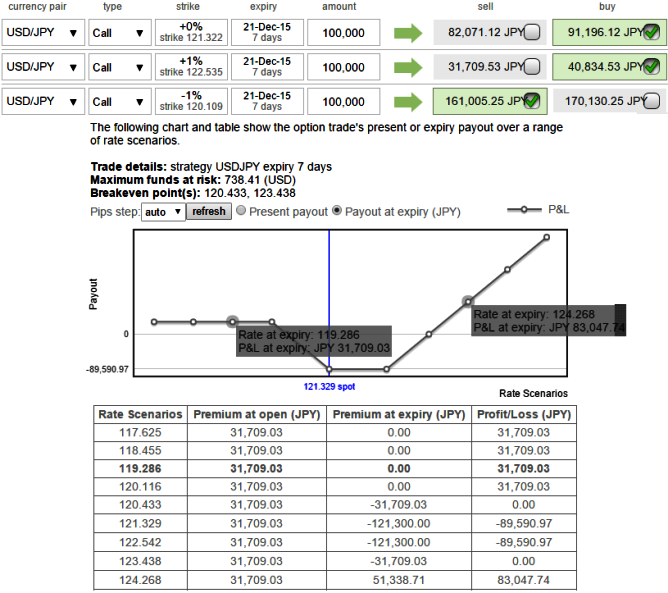

Hence, we recommend it is better to cover all your shorts and as shown in the diagram purchase 1 ATM call and (1%) OTM call and simultaneously short 1 lot of ITM call with shorter expiry in the ratio of 2:1.

The lower strike short calls because it finances the purchase of the greater number of long calls (ATM calls are expensive, so we chose 1% OTM calls as well) and the position is entered for no cost or a net credit.

The current IV of USDJPY ATM options is over 12% which is quite higher side, usually if the Vega of a long option position is positive and the implied volatility rises or dips, the above stated option prices are directly proportional to the implied volatility.

FxWirePro: Dollar gains likely, transform USD/JPY short covering into CRBS

Monday, December 14, 2015 8:38 AM UTC

Editor's Picks

- Market Data

Most Popular