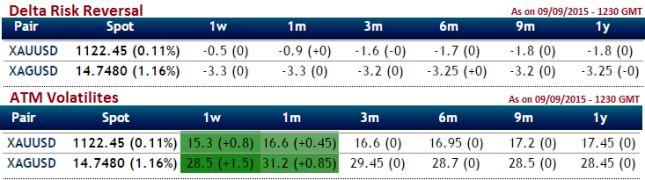

From the above table you can observe the delta risk reversal has shifted into red zone again with increased volatility. Gold was fallen to five and half years low of $1,071.28 on 20th July amid the Fed's speculation of rising interest rates in September for the first time since 2006. Since then we already reiterated the prices to have rebound approximately 3%. Gold prices have been consistently rising from then to hold near a three-week high as China's surprise move to devalue its currency fanned optimism that the Federal Reserve could delay raising interest rates until the very end of 2015. Further the positions constructed for bull overview will increase in value with time decay. But for now rate hike is almost deferred and what do you think can be the impact on gold?

After this short term price recoveries, negative delta risk reversal numbers as shown in the nutshell suggests downside hedging has been relatively expensive which means anticipation of gold prices to fall and daily technical chart makes us to have quite dubious eyes on prevailing bull run as there is now bearish signal generated by weekly RSI and slow stochastic, while stochastic has approached overbought trajectory and %D crossover suggests bearish trend to prevail.

Option Strategic Framework: Option strips (XAU/USD)

Buy 15D At-The-Money delta call option and simultaneously short 2 lots of 15D At-The-Money put options with positive theta values. As we anticipate this precious metal to fall in short to medium run but as a matter of hedging in long run, this strategy involves buying a number of ATM calls and double the number of puts.

FxWirePro: Delta risk reversal signals XAU/USD’s hitch – prefer strips for hedging as bearish sentiment intensified

Wednesday, September 9, 2015 12:51 PM UTC

Editor's Picks

- Market Data

Most Popular