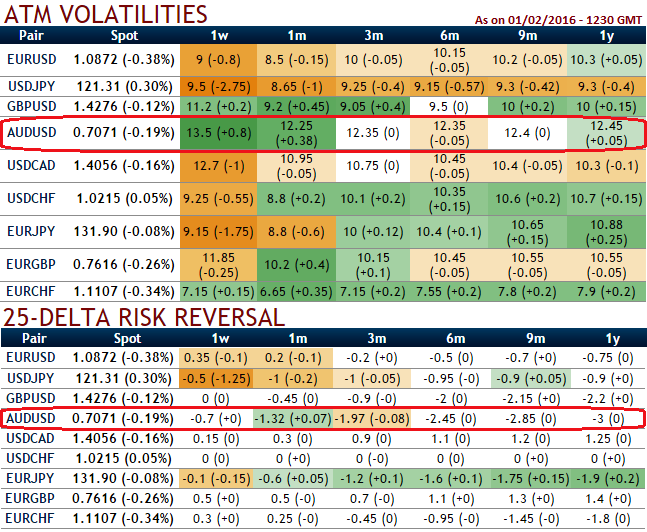

Delta risk reversals of AUDUSD: After the momentary upswings to 0.7141 (lower highs), the OTC market sentiments appeared to be more bias towards downward direction, the pair over all time horizon shows more weakness as the hedgers have been cautious on long term downtrend that has lasted since mid-April 2013 and as a result delta risk reversal for AUDUSD was turning into negative.

From the table showing OTC market barometer, 25-delta risk of reversal of AUDUSD has been the most expensive pair to be hedged for downside risks among G20 currency space both in short run and long run as it indicates puts have been overpriced contracts.

25-delta risk reversals show the difference in volatility, and therefore price, between puts and calls on the most liquid out-of-the-money (OTM) options quoted on the OTC market. As it showed the highest negative values indicate puts are more expensive than calls (downside protection is relatively more expensive which means more downward interest in the spot FX market).

In addition to that, as you can make out from the diagram the implied volatility for near month at the money contracts of AUDUSD pair has also been highest among G20 currency segment and is seen at around 12-13% levels for all time frames.

You can trade the IV value by monitoring risk reversals and an IV chart for a specific underlying market for a certain time period and determine the IV range, thereby you will see more selling pressure pumps up. The peaks suggest the option is expensive to buy and the troughs suggest the option is inexpensive. This information can be used when deciding which options to buy or sell.

We believe that AUD/USD's consistent supply is majorly due to Chinese pressure, when the PBoC came out and prompted what had been expected of them in as much of the poor performances of the economy of late. If Chinese reserve drawdown accelerates, we would look for AUD to trade lower.

AUD/USD is still stuck in its 0.68/0.74 range in H1 2016, mirroring the lack of direction in front-end AU-US rate spreads. We think the spread could narrow from both sides over the next 3m, pushing AUD/USD lower. The official forecast calls for two more cuts from the RBA in H1 2016 though there is a higher risk now that those cuts are delayed and kept unchanged at 2.0%. But under our base case, we look for AUD/USD to end Q4 not far from current spot in Q4 (end-Q4 target 0.69).