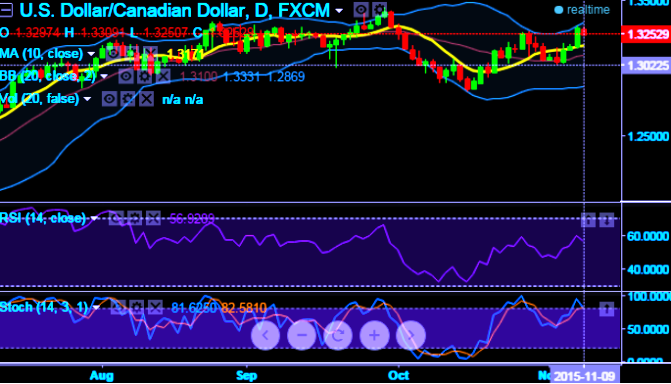

The prevailing uptrend of USD/CAD seems to be exhausted in an attempt to evidence month's high, for now the pair is looking weaker as it was unable to sustain 1.3316 (2 months highs).

The leading oscillating indicator RSI (14) signals selling momentum as the RSI curve and dipping prices began diverging.

Slow stochastic is also signifying the overbought pressure as %D line crossover above 80 levels indicate selling pressures.

Since we anticipate minor corrections in this pair in short run, the At-The-Money delta call of USD/CAD value indicates the option's equivalent position in the underlying market.

ATM calls might be luring for many speculators or hedgers at this moment.

Let's suppose for instance, USD/SGD ATM call option with Delta +0.5 can be delta hedged by selling 50,000 USD against SGD in the underlying spot FX market.

Delta value indicates the option's equivalent position in the underlying market. Hence, to hedge an option, you take the opposite position in the underlying market.

You would want to do this if you have a book of open options and you want to negate the risk of market moves without having to close the options.

FxWirePro: Delta hedging of USD/CAD ATM calls as uptrend seems to be puzzling

Monday, November 9, 2015 1:08 PM UTC

Editor's Picks

- Market Data

Most Popular