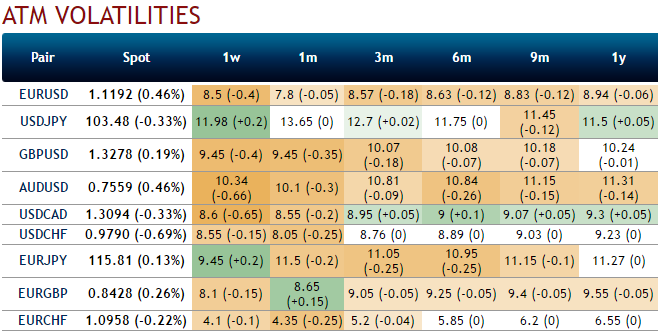

As the delta risk reversals of EURJPY have again shown in bearish interests as the progressive increase in negative numbers signify the traction for hedging sentiments for further downside risks in both short and long term.

Guaranteed hedge at the lower strike (worse than the outright forward rate if unleveraged) in order to benefit from a favorable market move up to the higher strike.

How it works: At expiry, one of the following scenarios may occur: 1) Underlying trades below the lower strike, you should short the notional amount at the lower strike.

2) Underlying trades at or above the Lower Strike and below the higher strike, no transaction takes place on the settlement date. You could sell the notional amount at the prevailing spot rate (outside this structure).

3) Underlying trades at or above the Higher Strike you are obliged to sell the notional amount (multiplied by the leverage factor, if any) at the higher strike. Your profit potential is limited at the higher strike.

We recommend initiating short EURJPY positions for the long term by bidding 1m risk reversals hedging but by capitalizing on every short-term upswing, preferably via options ahead of next week’s ECB meetings.

Despite acknowledging the recent uptick in the implied volatility of Euro crosses, especially EURJPY with higher negative risk reversal is justifiable when you have to observe the spot curve of this pair (see IV and RR nutshell and compare this with spot prices).

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation