The news of the additional US tariffs also resulted in EM currencies/equities crumbling overnight. Apart from the Chinese readings, Asian manufacturing PMIs came in mixed to weaker. Short-end EMFX vols are ‘waking up’ again, with Chinese equities slumping in early trade on Friday.

Overall, expect USD-Asia upside to persist, especially with regional currencies now lacking the buffer of net portfolio inflows. Asian (govie and IRS) yields meanwhile may be expected to take the cue from the global core curves and explore the downside once again, flushing out any ambiguity witnessed immediately after the FOMC.

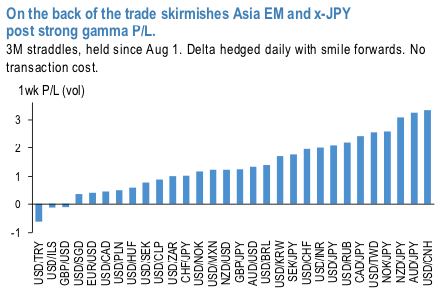

Spot gyrations generated strong gamma returns especially in Asia EM and x-JPY (refer 1st chart). How widespread and how impactful the trade escalation has been the best seen from the 1-week returns which are >90 percentile of YTD weekly returns for 26 out of 30 currencies in the Exhibit. We do not see a quick resolve and remain defensive though the current indications are that PBoC may want to bring back calm into FX.

The PBoC activity on clamping down the CNY day-to-day spot moves over the last few sessions shows that the central bank might be comfortable with the current level of FX weakness. CNY vols came off from the recent multi-year highs, and the 6M is now back to sub-6vol handle. The US-China trade developments remain very fluid and we are bound to see a few more adverse episodes.

Cheap vega ownership: In anticipation of the vega tenors receiving more attention with the spot now under the watchful PBoC hand, we recommend using the favorable vol entry levels to add vega.

Moreover, pricing of the CNH skew offers an attractive setup to own cheap CNH vol exposure directly via 6M 25D USDCNH puts (delta-hedged), i.e. to own the weak (or the "wrong") side of the risk- reversal. The structure provides long vega exposure but at smaller decay costs. The choice of the delta strike (25D to 35D) reflects a trade-off between deriving adequate discount vis-à-vis ATM vols and gamma/vega exposure. Based on the historical P/L time series in 2nd chart the "wrong" side OTM vega has been an efficient proxy for the CNH ATM straddles during adverse episodes.

Consider: 6M or 9M USDCNH 25 delta puts @5.4/5.725 indic for 6M and @ 5.375/5.675 indic for 9M, delta hedged. Courtesy: JPM

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures