With just five and a half months before the planned Brexit date of 30 March 2019 and an agreement providing for the UK’s orderly exit from the European Union (EU) yet to be reached, EU/UK official talks on a withdrawal agreement in accordance with Article 50 of the EU Treaty, have gained pace. Not long ago, EU Brexit Commissioner Michel Barnier stated that it is “realistic” to expect a withdrawal agreement (i.e. a deal on the first phase of Brexit negotiations) by mid-November.

Admittedly, out of the five priority issues necessary for a withdrawal agreement, three have already been settled: EU citizens’ rights, UK financial commitments and the 21-month status quo transition period after the UK’s exit to allow time for consumers, businesses and public bodies to adjust to changes in the rules governing their operation as a result of leaving the EU.

However, there is no doubt that Great Britain’s exit from the EU next March will constitute a historic event. In view of such a far-reaching step GBP exchange rates are remarkably stable. In fact, Sterling has even recovered slightly from its lows against USD and EUR following the Brexit referendum, despite the fact that the negotiations between the British government and the EU partners have turned out to be extremely tough.

That suggests that the market believes that an amicable agreement will be reached in the end, something we project likewise.

The reality, however, is that an amicable settlement is likely to drag on for some time yet, which means that we expect the pound to weaken somewhat due to the uncertainty surrounding a possible exit without an agreement (“hard Brexit”).

We see a 40% likelihood of a no-deal Brexit. An important reason for the overall robust development of GBP over the last quarters is also that the British economy has survived the initial shock of the Brexit decision far better than expected. As a result, the Bank of England (BoE) was able to focus much more on the inflationary risks.

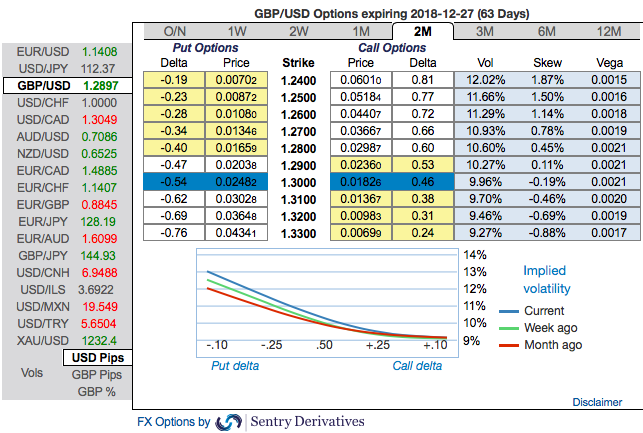

GBP OTC outlook:

Positively skewed implied volatilities of 2m tenors signal bearish hedging sentiments. To substantiate this downside risk sentiment, negative risk reversals indicate mounting bearish sentiments.

We reckon that the sterling should not suffer like before in the near terms, but, one should not disregard Fed’s hiking cycle and Brexit negotiation on the other hand. The market has always ignored the fact that all the current BoE interest rate moves are due to a favourable result of the Brexit process.

Both the speculators and hedgers of GBPUSD are advised to capitalize on the prevailing price rallies for bearish risks and bidding theta shorts in short run (1m IVs) and 3m risks reversals to optimally utilize delta longs.

On hedging grounds, fresh delta longs for long-term hedging comprising of ATM instruments and OTM shorts in short-term would optimize the strategy.

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at -122 (which is bearish), while hourly USD spot index was at 58 (bullish) at 11:28 GMT. For more details on the index, please refer below weblink:

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed