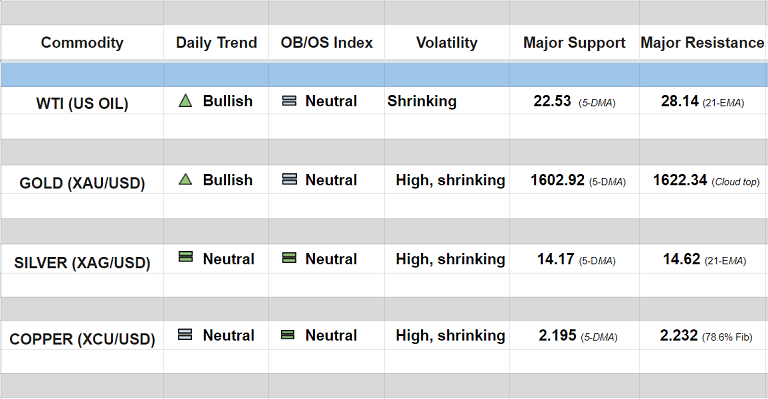

Daily Commodity Tracker (11:00 GMT)

WTI (US OIL):

Major trend - Strongly bearish; Minor trend - Turning bullish

Oscillators: Rollover from Oversold (bias higher)

Bollinger Bands: Shrinking on Daily charts, Widening on Weekly and Monthly charts

Intraday High/Low: 26.99/ 23.55

GOLD (XAU/USD):

Major trend - Neutral; Minor trend - Turning bullish

Oscillators: Neutral (Bias higher)

Bollinger Bands: Shrinking on the daily charts, volatility remians high

Intraday High/Low: 1617.532/ 1607.176

SILVER (XAG/USD):

Major trend - Strongly bearish; Minor trend - Turning bullish

Oscillators: Neutral (Bias higher)

Bollinger Bands: Shrinking on Daily charts, Widening on Weekly and Monthly charts

Intraday High/Low: 14.54/ 14.30

COPPER (XCU/USD):

Major trend - Strongly bearish; Minor trend - Neutral

Oscillators: Neutral (Bias higher)

Bollinger Bands: Shrinking on Daily charts, Widening on Weekly and Monthly charts

Intraday High/Low: 2.230/ 2.200

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed