Daily Commodity Tracker (11:30 GMT)

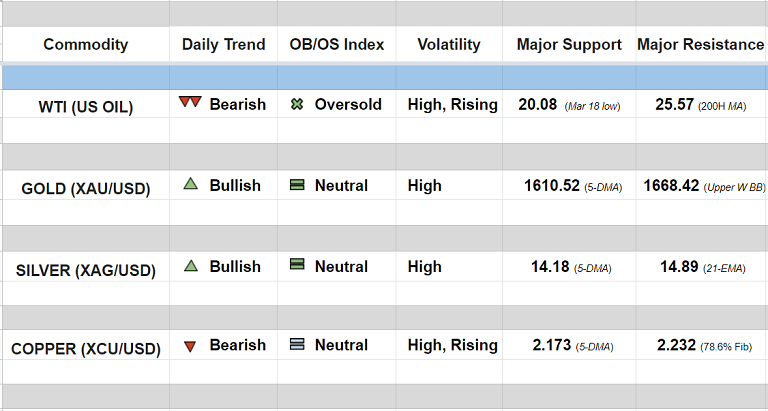

WTI (US OIL):

Major and minor trend - - Strongly bearish

Oscillators: Oversold (no sign of reversal)

Bollinger Bands: Widening on Daily, Weekly and Monthly charts

Intraday High/Low: 23.39/22.42

GOLD (XAU/USD):

Major trend - Neutral; Minor trend - Bullish

Oscillators: Neutral (Bias higher)

Bollinger Bands: Widening on Monthly charts

Intraday High/Low: 1634.049/ 1614.972

SILVER (XAG/USD):

Major - Strongly bearish; Minor trend - Turning Bullish

Oscillators: Neutral (Bias higher)

Bollinger Bands: Widening on Weekly and Monthly charts

Intraday High/Low: 14.63/ 14.28

COPPER (XCU/USD):

Major and minor trend - Strongly bearish

Oscillators: Neutral (near oversold)

Bollinger Bands: Widening on Daily, Weekly and Monthly charts

Intraday High/Low: 2.202/ 2.167

FxWirePro: Daily Commodity Tracker - 27th March, 2020

Friday, March 27, 2020 11:34 AM UTC

Editor's Picks

- Market Data

Most Popular

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data