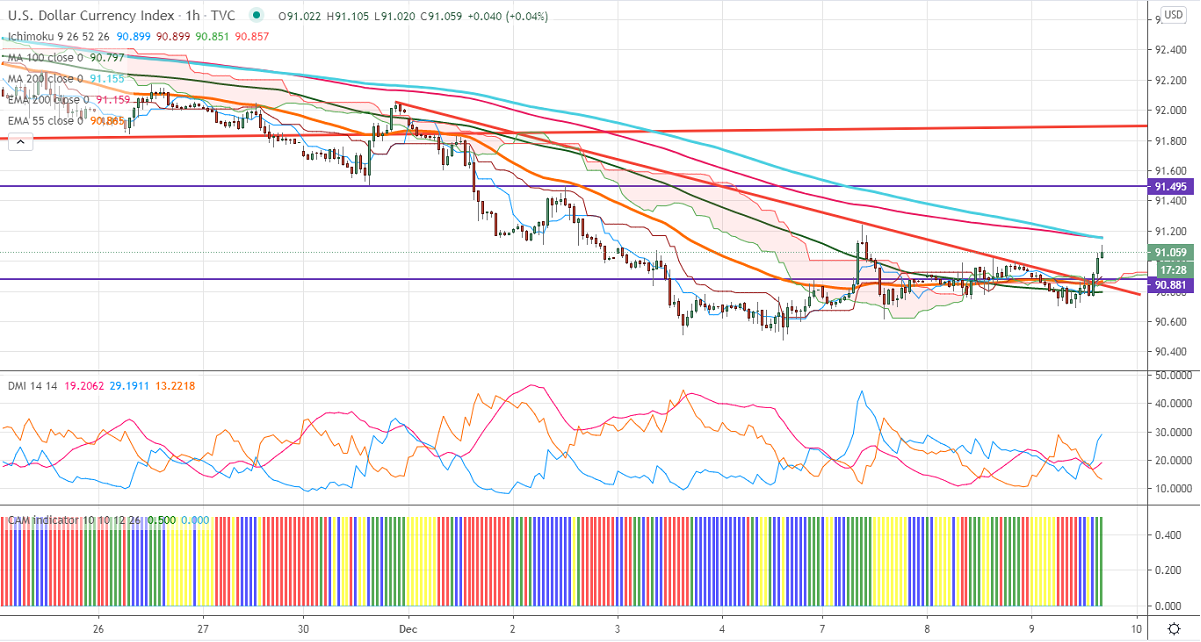

Ichimoku Analysis (1-hour chart)

Tenken-Sen- 90.872

Kijun-Sen- 90.872

US Dollar index is trading higher for the past third consecutive days on Brexit and US stimulus uncertainty. UK PM Boris Johnson to meet European Commission President Ursula von der Leyen regarding the Brexit deal. Short term trend on DXY is still bearish as long as resistance 91.50 holds. The index lost more than 4% in the past 6 weeks on vaccine optimism. Markets eye US CPI and jobless claims data tomorrow for further direction. It hits an intraday high of 91.10 and is currently trading around 91.10

On the higher side, near-term resistance is around 91.50, any convincing violation above targets 92/92.27/92.53. Significant bullishness only if it closes above 93.20.

The index is facing strong support at 90.50, any indicative break below will take the index till 90/89.85.

It is good to sell on rallies around 91.10-20 with SL around 91.50 for the TP of 89.