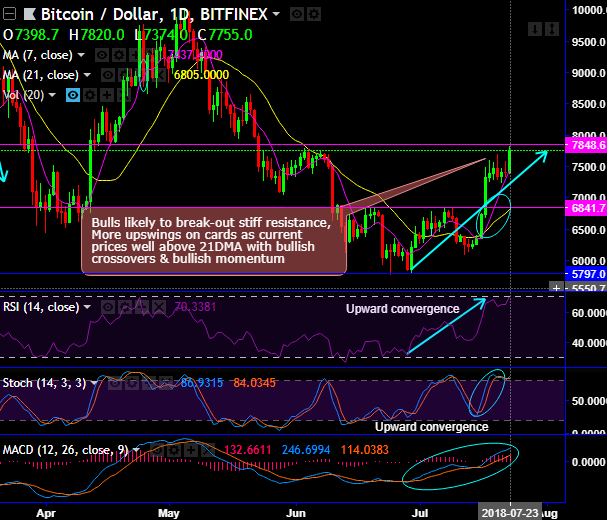

Ever since Bitcoin prices are bottomed out at $5,755 levels, bullish sentiments have been intensified. Technically, BTCUSD bulls likely to break-out stiff resistance, for now, more upswings on cards as the current prices well above 21DMA with bullish crossovers and bullish momentum.

With the resumption of sharp bull swings of BTCUSD (currently trading at $7,768 levels), in the recent past, it’s been noticed that various regulatory and trade-related service developments are lingering around cryptocurrency space.

Late last year, the cryptocurrency market surged to $900 billion in valuation when BTC reached its all-time high to 20k. One can’t rule out that the real impact of Bitcoin futures was the price of bitcoin, achieved $20,000 during its announcements of CME introducing futures contracts and the price of ether broke $1,400. But, in January, the price of cryptocurrencies started to drop, eventually recording a 70 pct correction within a seven-month span.

While we’ve observed the sharp price rallies in BTCUSD pair on the eve of launching the CBOE and CME bitcoin futures market. Thereafter, the abrupt shift in trend from a bullish market to a strong bear cycle was observed ever since the launch in December 2017 (considerable slumps from the highs of $20k to the recent $5,755 levels).

The conventional and high-value investors are wary of cryptocurrency exchanges, especially contemplating the major issues such as price volatility, frequency and quantum of major hacks. Such investors often feel more comfortable with the safe custody of their assets provided by banks and financial institutions.

While the institutional investors are also likely to seek out an over-the-counter (OTC) desk for ease of investment with more conventional style. As a result, financial institutions new and old are creating OTC desks. Since OTC cryptocurrency transactions are usually of a higher value, demand for digital asset storage is boosted.

For an instance, the cryptocurrency exchange Coinbase, with an intention of meeting rising needs of professional products designed to attract institutional investors, unveiled Custodian service from July 2, 2018, for the U.S and Europe. It aims to roll out the service for Asia as well by the end of the year.

The Coinbase Custody fixes a standard balance of $10 million USD for the use of the service which is currently “on-boarding” with a class of top-notch clients that includes leading crypto hedge funds, exchanges, and ICO teams.

While the SEC, recently announced that they propose to ease ETF approval rules, especially for low-risk ones, which in turn, the commission received various constructive responses. This would allow companies to issue “plain vanilla versions” of the ETF without seeking approval.

Consequently, BTC ETF has been one significant aspect that would, probably, allure the inflow of institutional and HNI funds into crypto-avenues. While there may be abundant BTC to invest in. For Bitcoin, the institutional money inflow in a fully legalized asset like an ETF would be an indication of authenticity. Some traditional finance firms have made forays into Bitcoin, but those were mostly small-scale test investments.

Currency Strength Index: FxWirePro's hourly BTC spot index is at shy above 152 levels (which is bullish), while hourly USD spot index is edging higher at -79 levels (bearish) while articulating (at 07:30 GMT). For more details on the index, please refer below weblink:

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes