The New Year series has been subdued for CAD: on the back foot largely as a result of tumbling crude oil prices.

The present-day situation has USDCAD trading to an 12-1/2 years high as crude oil prices forge a new cycle low below USD 34.00/brl mark in the aftermath of US EIA's inventory reports that evidences a dip in stocks (-5.1M vs forecasts at 0.7M and previous prints at 2.6M).

This should maintain headwinds for the Canadian economy as we enter 2016, with GDP growth hampered by additional cuts to energy capital expenditures that, in turn, detract from business investment.

The forecasts for WTI cut to $52/B for 2016 and $62/B for 2017 from $57 and $65 respectively, no scene of recovery in CAD unless this energy commodity bottoms up and shows signs of recovery as pr the forecasts.

We are revising our USDCAD profile higher in the short-term (1.45 for Q1 end) with the risk that we trade higher intra-quarter or CAD recovers sooner if oil manages to stage a rally.

Thus, we stress that the lack of a recovery in crude oil prices remains the most important risk to our CAD outlook. This would likely establish new stage for USDCAD bulls run in Q1 of 2016.

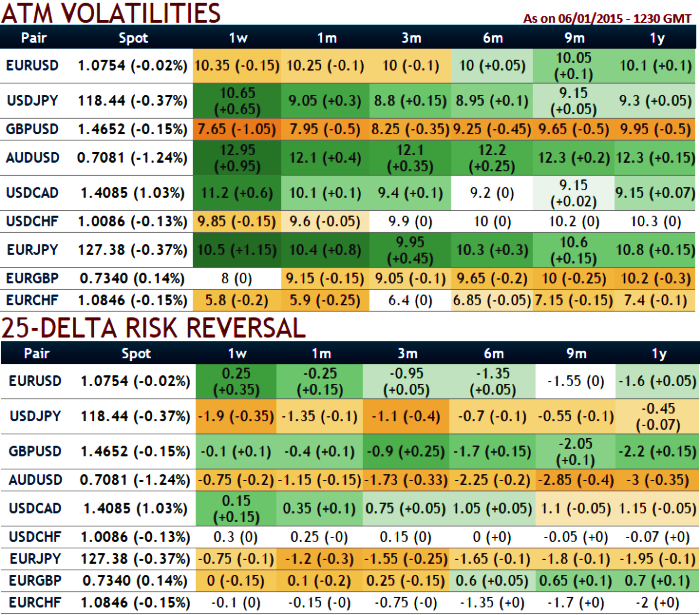

As shown in the above table, the current IV of USDCAD 1w contracts is second highest among currency pool at 11.2%, this higher IV is conducive for option writers. While OTC market sentiments indicates that upwards risks of underlying spot FX as risk reversal shows expensive hedging for upside risks.

Usually if the Vega of a long option position is positive and the implied volatility rises or dips, the below advised option prices are directly proportional to the implied volatility.

Hence, we recommend it is better to cover all your last week shorts and go long in 2w ATM +0.51 delta call and 1M (1%) OTM 0.38 delta call and simultaneously short 2D 1 lot of ITM call with shorter expiry in the ratio of 2:1.

The lower strike short calls because it finances the purchase of the greater number of long calls (ATM calls are overpriced, so we chose 1% OTM calls as well) and the position is entered for no cost or a net credit.

FxWirePro: Crude continues to hurt CAD – USD/CAD Call Ratio Back Spreads to hedge extended upside risks

Thursday, January 7, 2016 11:40 AM UTC

Editor's Picks

- Market Data

Most Popular