The weakness in Turkish assets accelerated over the past week. The lira has weakened by around 2% against the US dollar since the start of November, underperforming other EM currencies (refer above chart). The underperformance has been driven in part by a worse-than-expected CPI inflation.

We are UW both duration and FX in Turkey in the GBI-EM Model Portfolio, with a preference for FX UWs. We believe there is a good case to enter fresh bearish positions in both local bonds and the currency at current levels.

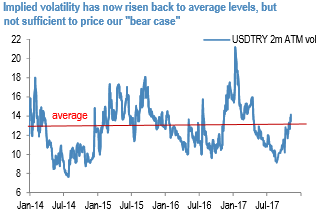

We have a preference for entering bearish positions in the currency, as the CBRT is likely to only hike rates in response to currency weakness, and hence, we keep a larger FX UW relative to duration. In outright trades, we recommend buying a 2m 4.10 USDTRY call. The option market has so far priced in only a moderate deterioration in the outlook for lira with close to average levels of implied volatility and skew (refer above charts).

However, as we are in our view now transitioning towards our “bear case” scenario of an increasingly negative feedback loop between the currency, asset prices, and outflows, we can envisage a much more fragile pattern before the central bank is forced to step-in a credible manner. The situation is likely to be exacerbated by negative current account seasonality in December and low liquidity around the year-end.

We, therefore, recommend buying a 2m USDTRY 4.10 call indicatively priced at 1.26% (spot ref. 3.8850) to take advantage of the likely rise in volatility and skew as USDTRY trades higher. The risk on the trade is limited to the premium paid. Courtesy: JPM

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data