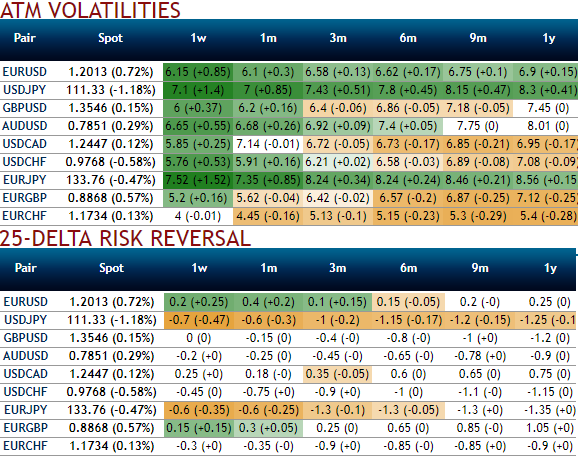

The global picture on the volatility front hasn’t really changed in recent months. Implied and realized volatility is still hovering in their low or very low percentiles.

The currency market has been acting as the adjustment factor between countries positioned at different parts of the economic cycle clock. Please refer above nutshell that evidences depressed volatility keeping entry costs low while uncertainty is still lingering the probability of a positive return. Japan and core euro zone are our preferred markets.

It has been one of the few assets on which carrying long volatility positions has not been a constant pain. It has also led to a dramatic reversal in the correlation regime, leading to some significant discounts on equity options contingent to currency levels.

The fundamental motivation for owning GBP volatility was straightforward and colored by uncertainty on multiple fronts – around the Brexit process, increasingly dysfunctional domestic politics, continued debate around the abrupt change in the BoE’s reaction function and the risk of an unwind of rate hikes priced along the yield curve should growth and/or politics intercede.

With current levels of implied vols still low, we continue to find value in holding this trade.

Long a 1Y vol swap in EURGBP. Opened at 8.85%November 21. Marked at 8.15%.

Elsewhere, even though not explicitly an Outlook 2018 theme, we had spotted out and highlighted the luring factor of owning CAD-denominated correlations, specifically CADUSD vs CADJPY as a positive carry NAFTA hedge in December. CAD and MXN have already proven relative outperformers since then amid the broad-based softness in vols elsewhere (refer above chart), which allied with the collapse in USDJPY vol has helped this trade: realized CADUSD – CADJPY corrs have clocked almost 20 points over implieds since publication, and there is value still to be extracted from CADJPY vs USDJPY vol spread.

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close