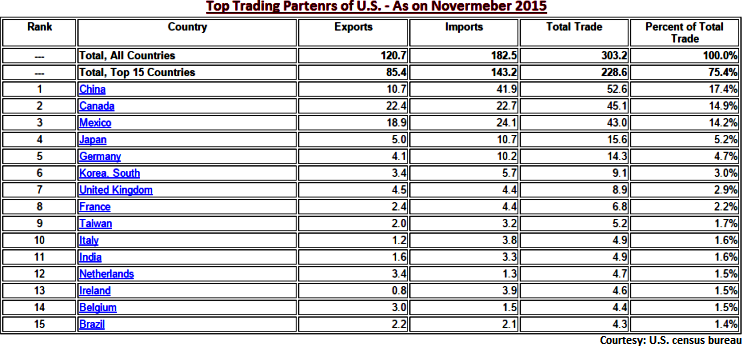

The beginning weeks of 2016 dealings began against the backdrop of a fresh spells of Chinese equity/FX market tension. Notably, China has been second largest trade partner and 1st to evidence highest US trade balance.

The CSI300, the benchmark index against which China's new circuit breakers are set, dropped -102.84 (3.19%) after last week's plunge of 7.21%. On the mainland, the Shanghai composite tumbled 7.32% by at the time of the halt, while the Shenzhen composite plummeted 8.34%.

It is notable that the US dollar has jumped up so much even earlier than the Fed signaled the rate hike button. The dollar even surged while Fed hike expectations retreated. But the policy divergence will still be a factor in 2016.

The USD peak will come but not at the first Fed hike and maybe not until mid/late 2016. the trade-weighted index posts at least one more surge this cycle, with 2016 gains of 4% concentrated versus EM/commodity FX. Most moves end by Q2 except EM Asia, which weakens for longer.

The market has pared back expectations of the hiking cycle, despite reasonable labor market data. This appears in response to the tightening of financial conditions and resulting greater worries about downside risks to the economy.

Although the three forces that have propelled the dollar this far -monetary policy divergence, emerging markets growth slump, commodity oversupply -have not played out fully, many are skeptical about further gains given the feedback loop from a strong dollar to Fed policy, the current account adjustment in many countries, and the attraction of cheap EM assets.

US Treasury: We recommend buying 1x2 3m*2y payer spreads for a small sell-off at the front end. We believe buying 3y*2y low strike (1%) receivers vs. 1y*2y2y receivers is attractive for a large rally over the longer term. We maintain our 5s30s curve-flattener recommendation.

FxWirePro: Chinese slowdown, oil turmoil may impact FED hike deferred expectations in H2 2016

Friday, January 15, 2016 10:43 AM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?