The BoC left interest rates unchanged last month but noted that the risks to inflation had tilted to the downside. In today’s monetary policy meeting, the Canadian central bank is likely to keep overnight rates unchanged at 0.50%. While AUD held onto gains following the RBA Governor’s speech yesterday. RBA, on the other hand, continue to see rates on hold at 1.5% for an extended period.

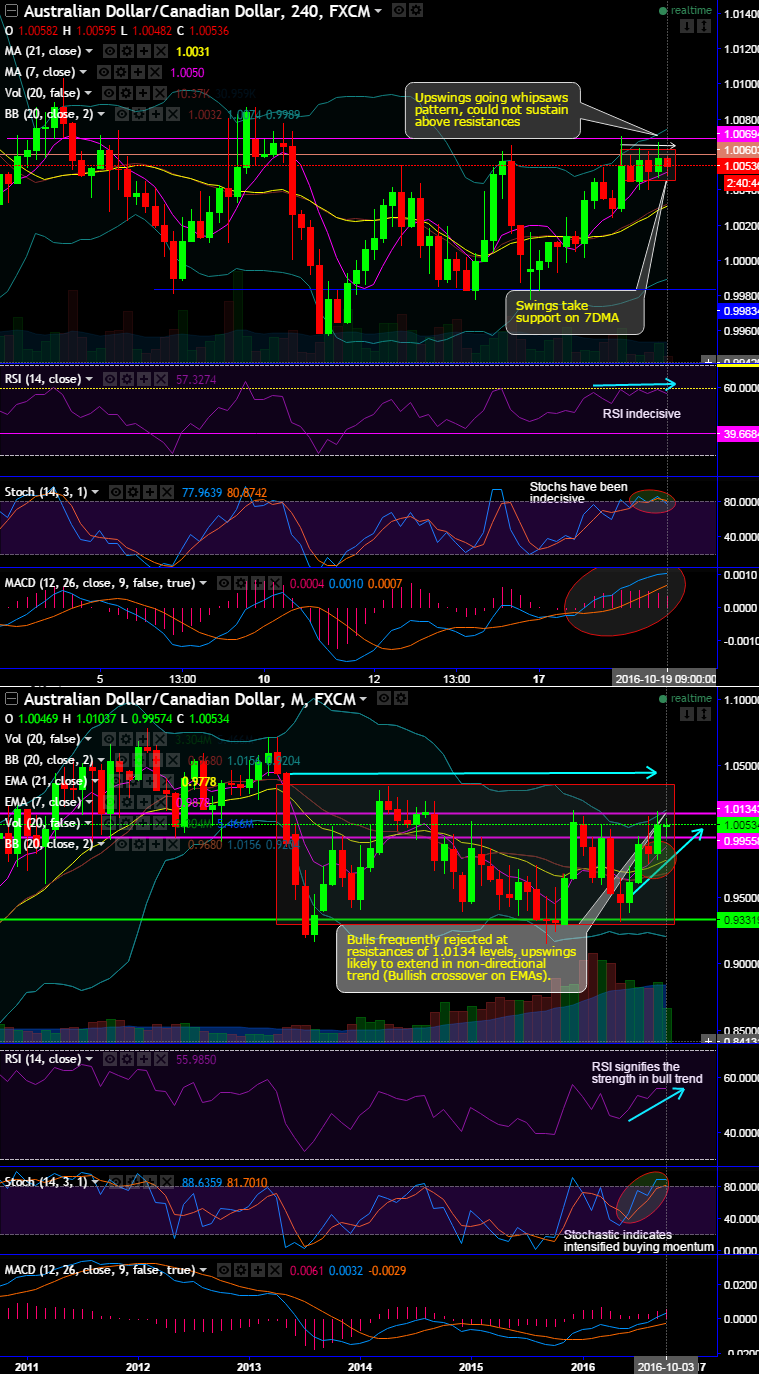

As a result of above central bank movements, in the recent AUDCAD price behavior, the whipsaw pattern has been evidenced (see rectangular shaped area).

Previous upswings have been restrained at resistances of 1.0065 on daily and 1.0135 levels on monthly terms.

Well, contemplating previous upswings prior to this pattern, more slumps are likely after whipsaws formation, any slide below 7DMAs would evidence more slumps in the days to come.

Leading oscillators are quite puzzling, while RSI, Stochs & MACD suggestive of bullish trend continuation but the current prices have been slightly edgy.

RSI has been drifting sideways and is indicative of losing strength in last month’s upswings and for now it’s been quite indecisive at the current juncture, while stochastic curves have been reached overbought zone and attempting to show %D crossover.

On a broader perspective, bulls rejected frequently at the resistance of 1.0135 levels, massive volumes formed on declining prices in non-directional trend.

Intraday sentiments have been little bearish, while traders on delivery basis should focus on dips for fresh longs as the upswings likely prolong.

Trade tips: Well, on speculative grounds, we recommend diagonal credit call spreads.

1m ATM IVs of AUDCAD is crawling up 7.70% which is on the lower side, option writers could optimally utilize this low volatile circumstance.

Thus, it is advisable to initiate Diagonal Credit Call Spread (DCCS) in order to tackle both short-term abrupt dips and major uptrend.

Execution: Keeping the both fundamental and technical factors in mind, it is advisable to go long in 1M (1%) OTM 0.36 delta call while writing 1W (1%) ITM call with positive theta and delta closer to zero (both sides use European style options), this credit call spread option trading strategy is recommended when the underlying spot FX price is anticipated to drop moderately in the near term and spikes up in long term.

The return is limited by ITM shorts. No matter how far the market moves below that point, the profit would be the maximum to the extent of initial premiums received.