The monetary policy announcement at the ECB is the most notable event today. As nothing meaningful is expected from Draghi, the price rallies of EURUSD have halted at neckline and oscillate between the mid-points of the current 1.1510 to 1.1800/1.1850 range. ECB policy has proved a modest disappointment for EUR as the last meeting deferred a hike until at least autumn 2019 even as QE is set to end this December, albeit subsequent commentary points to divisions in the council over the exact timing of the first hike.

Bearish EURUSD scenarios:

1) ECB delays hiking until 2020 as growth and core inflation struggle.

2) Faster US corporate repatriation.

3) Excessive fiscal loosening in Italy (2-ppt+)

4) US auto tariffs

Bullish EURUSD scenarios:

1) Growth rebounds to 2.5-3% by mid-2018;

2) ECB becomes more comfortable with progress on wages and core inflation and softens calendar-based rate guidance.

Europe’s migrant deal is potentially significant for EUR as this issue has detracted from what has been a steady normalization in the European data flow. With political risk now subsiding, there's scope for EUR to modestly rebound in line with neutral data surprises.

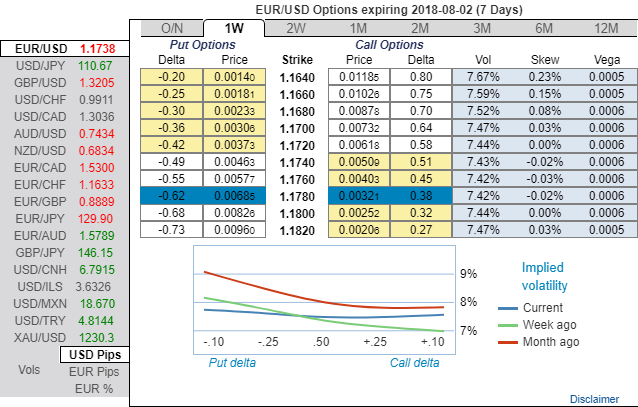

OTC outlook: Implied volatility skews of 1w tenors have been well balanced on either side, that means both bulls and bears are on equal advantages.

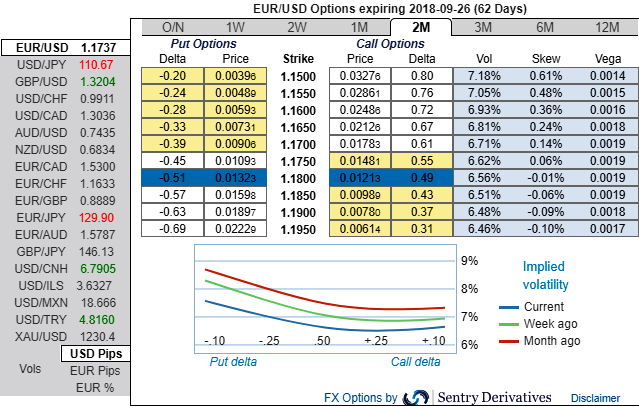

The positively skewed IVs of EURUSD of 2m tenors signify the hedging interest of bearish risks.

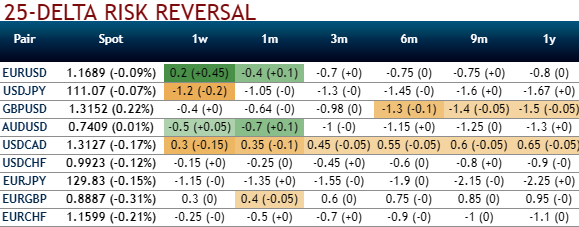

Same has been the case with risk reversal indications. RR numbers of 1w-1m expiries show mild bullish risks in short-term. While bearish risk sentiment remains intact in the long-run (refer long-term risk reversal numbers).

Contemplating above-stated driving forces and OTC indications, as shown above, accordingly options strips strategy is advocated on both trading as well as hedging grounds. The options strips strategy which contains 3 legs needs to be maintained with a view to arresting price downside risks.

Option Strategy: Options Strips

Combination ratio: (2:1)

Rationale: Considering the bullish (in near-term) and bearish technical environment (in long-term) and most importantly, the skews in the sensitivity tool indicate hedging sentiments for the bearish risks, these risks are coupled with bearish risk reversal numbers.

The execution:

As shown in the diagram, initiate long in 2 lots of EURUSD at the money -0.49 delta put options of 2M tenors, go long 1w at the money +0.51 delta call option simultaneously.

The strategy can be executed at net debit with a view to arresting FX risks on both sides and likely to derive exponential returns but with more potential on the downside.

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards -11 levels (which is neutral), while USD is flashing at -107 (which is bearish) while articulating at (08: GMT). For more details on the index, please refer below weblink:

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data