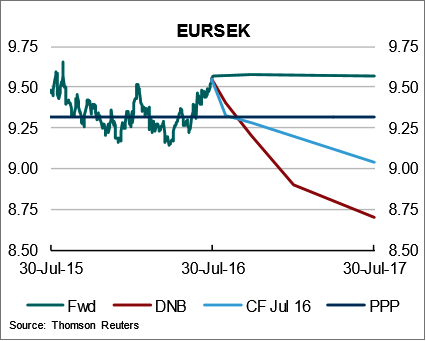

EURSEK has continued higher over the last month, trading a shy below 9.60, which is the highest level seen since last autumn.

The growth in Sweden is solid and inflation has risen. Despite the positive trend, the Riksbank is still worried about the inflation outlook. It is, in particular watching SEK developments, as a sharp appreciation may risk the inflation upswing.

While data still strong and capacity utilization is still higher than normal, data show a loss of momentum. Growth in Q2 disappointed.

Sweden's central bank left its benchmark repo rate unchanged at -0.50 pct on July 6th like other central banks and said it was ready to make monetary policy more expansionary if the inflation prospects deteriorate. However, the interest rate path was lowered as a result of more expansionary monetary policy in other countries.

The 3 months interest differential (SEK-EUR) has fallen 10bps last month. SEK 2017 FRAS has fallen 9-16 bps since June 24th, while similar EUR FRAs are up 2-3 bps.

The Riksbank has signalled that it is prepared to make monetary policy more expansive if necessary and the CB governor has been given powers to intervene. - As inflation picks up further, Riksbanken will gradually become more relaxed about the value of the SEK and to a larger extent again emphasize their financial stability concerns.

Our forecasts are 9.40, 9.20 and 8.70 in 1, 3 and 12 months. Hence, importers and exporters can prefer flexible forwards for their hedging portfolios. The suggested hedge is against NOK and based on FX market forecasts on a 6-month horizon.

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand