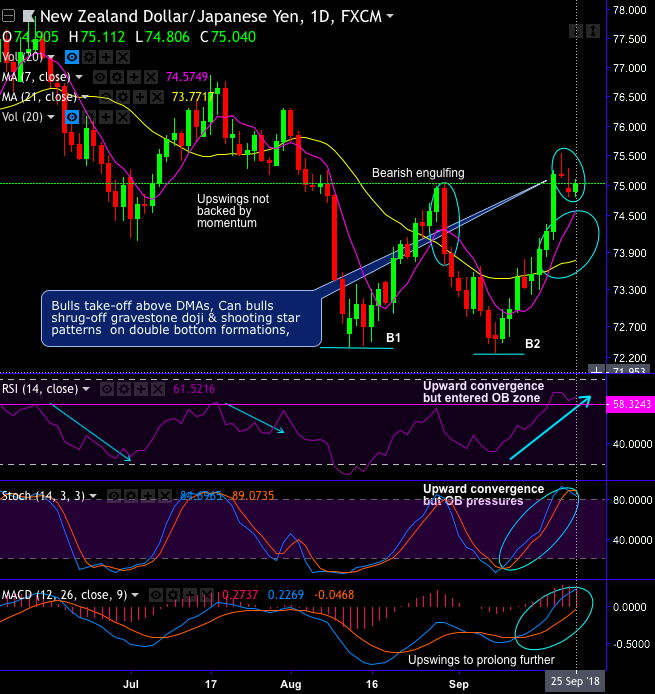

Chart and candlestick pattern: NZDJPY forms gravestone doji and shooting star 75.174 and 74.904 levels. Double bottom pattern, with bottom 1 at 72.353 and bottom 2 at 72.254 levels (refer daily chart).

Consequently, the bulls bounce on this bullish pattern on daily terms, while the current prices of this pair take-off above well DMAs, for now, rallies for the day seem to be most likely but never rule-out above-stated bearish patterns and overbought (OB) signals.

More rallies seem to be on the cards upon bullish DMA and MACD crossovers & intensified bullish momentum.

On the flip side, it has been dipping constantly below 7EMAs ever since the formation of shooting star in the major trend (refer monthly chart). Now, bulls have managed to bounce back. But both RSI and stochastic curves on this timeframe have been constantly showing the downward convergence that indicates the strength and momentum in the bearish interests.

While the major downtrend still remains intact, in upcoming weeks bears likely to resume and prolong further slumps on bearish EMA and MACD crossovers (refer monthly chart).

Contemplating the prevailing bullish sentiments for the day and lingering bearish trend in the long-run, the below FX derivatives strategies have been advocated to suit both timeframes.

Trading and hedging tips: At spot reference: 75.084 levels, on trading grounds buy one touch call options with strike price at 75.289 levels.

While on hedging grounds, ahead of RBNZ’s monetary policy this week, long-term investors should stay short in futures contracts of mid-month tenors. The writers of the futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards 85 levels (which is bullish), while hourly JPY spot index was at -86 (bearish) while articulating (at 12:48 GMT). For more details on the index, please refer below weblink: