We highlight a number of tactical signals for the FX market and some options concepts that could accomplish well in a market scenario characterized by the US dollar strength over the medium term.

Since the election of Trump as US president in early November, EM currencies (with the Mexican peso in the frontline) have been under pressure, as the US dollar has appreciated sharply on expectations of a quicker rate hiking cycle in the US. Higher yields in developed markets reduce the appeal of investing in higher risk EM-denominated assets.

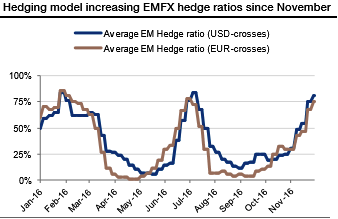

The above chart demonstrates that how the EM currency hedging model has quickly increased EMFX hedge ratios since the beginning of December. The current values are around 75%, well above the historical averages (35-40%). This indicates that the model suggests a prudent stance towards EMFX (the typical time horizon over which the model implements hedging decisions is around a month).

The general undervaluation of EM currencies is confirmed by this, which we often use a lens for screening cheap vs rich opportunities. MXN and TRY, two of the hardest hit EM currencies since November, stand out as the cheapest in the EM space. Possible RV trades for taking a position on the intra-EM dislocations could be short BRLMXN or long TRYZAR. In both cases, by studying the statistical betas of the crosses, the trades would be supported by a general decline of the US dollar.

The adagio “don’t catch a falling knife” might recommend prudence before playing an outright recovery of emerging currencies. In the first chart below, we display the performance of a mean-reversion strategy for G10 currencies, despite a convincing simulated track record since the 1980s and a good performance in the high-volatility market following the Brexit vote in the summer, the strategy has suffered since the pro-US dollar trend has strengthened. FX relative-value strategies could, therefore, deliver the best results as the long-USD trend begins to wane.

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?