Cable prices (GBPUSD) have collapsed considerably in the low liquid environment, with historically strong indicators not working at this juncture.

The prevailing price action continues to lurch lower, consolidate sideways for a while and then drop again. (The average true range over the last week has moved to around 278 pips, from around 100 around the beginning of March).

A recovery back through 1.1950-1.2050 would be a first indication of real stability. Otherwise, intra-day resistance lies in the 1.1675-1.1770 region ahead of there.

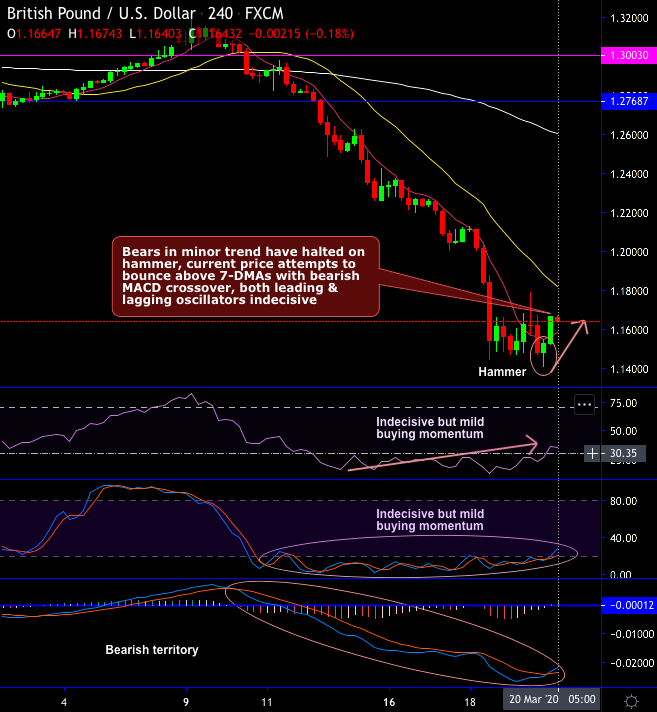

Overall, bears in the minor trend have halted on hammer formation, while the current price attempts to bounce above 7-DMAs with bearish MACD crossover, both leading & lagging oscillators indecisive.

On a broader perspective, hanging man pops at 1.3202 levels to disrupt the last 3 and a half years’ consolidation phase, while bears break-down triangle support (refer monthly chart). The current price tumbles below 7, 21 & 100-EMAs, consequently, the major downtrend resumes and hits multi-years’ lows (1.14) as both leading and lagging oscillators are bearish bias on this timeframe.

Next projected downside levels are 1.1110-1.1080, the psychological 1.10 region, then 1.0840-1.0800 with 1.0625/1.0590 below there. Bloomberg shows the 1985 low as 1.0520, but we reckon it traded down to 1.0045.

Trading tips:

Contemplating above technical rationale, tunnel spreads are advocated on trading grounds with upper strikes at 1.1792 level and lower strikes at 1.1409 levels (spot reference: 1.1650).

Alternatively, activate shorts in GBPUSD futures contracts of April’20 deliveries with an objective of arresting potential slumps.