The main event in the coming week’s UK economic calendar is the BoE’s MPC meeting on this Thursday. While the political and economic backdrop remains momentarily supportive of sterling’s underperformance. However, we continue to be short, using near-term upswings by unwinding the GBPUSD expression of the trade since this is currently in the money but has only less than a week to expiry and is close to the strike.

OTC Outlook:

Before we proceed further, let’s just quickly glance through the hedging outlook in FX OTC markets and formulate strategies.

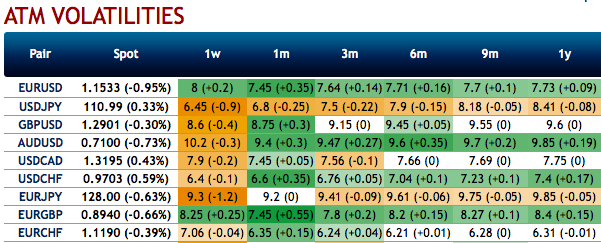

Please be informed that the positively skewed IVs of 6m tenors signify the hedgers’ interests to bid OTM put strikes upto 1.20 levels.

While the implied volatilities of 3m tenors are neutral to shrinking lower mode, shy below 9.15% on a lower side, which is perceived to be conducive for option writers. Whereas, 6m-1y IVs are on rising mode, well above 9.45%, rising IVs are good for options holders.

While the positive shift in delta risk reversal numbers (across 1-3m tenors) indicates mild recovery is anticipated in the underlying movements amid the bearish hedging activities for the downside risks remains intact in a medium-term perspective.

Strategic framework:

While contemplating above OTC bids, put spread like structures are advocated, wherein short leg is most likely to function during low IV environment coupled with the prevailing rallies of the underlying spot FX continue or remain above from the spot levels, we would like to uphold the same strategy on hedging grounds.

Both the speculators and hedgers for bearish risks are advised to capitalize on the prevailing price rallies and bidding theta shorts in short run (3m IVs) and 6m risks reversals to optimally utilize delta longs.

On hedging grounds, fresh delta longs for long-term hedging comprising of ATM instruments and OTM shorts in short-term would optimize the strategy.

So, the execution of hedging positions goes this way:

Short 3m (1%) OTM put option (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, initiate longs in 6m ATM -0.49 delta put options. A move towards the ATM territory increases the Vega, Gamma and Delta which boosts premium.

Thereby, the above positions address both upswings that are prevailing in short run and bearish risks in long run by vega longs.

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards 26 levels (which is mildly bullish), while hourly USD spot index was at 127 (bullish) while articulating (at 07:31 GMT). For more details on the index, please refer below weblink:

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One