The fifth round of Brexit talks starts this week, with fading hopes that there will be “sufficient progress” on separation issues in time for the EU leaders’ meeting later this month.

The pound has been under pressure over the past week, as domestic political uncertainties increased following PM Theresa May’s speech at the party conference.

Cable has witnessed consolidation phase since October 2016 from the lows of 1.2946 levels to the recent highs of 1.3658 levels.

While implied volatilities still skewed to the downside: Please glance through the nutshell evidencing IVs of 2m tenors that signifies the hedgers’ interests of OTM put strikes amid major consolidation phase of GBPUSD.

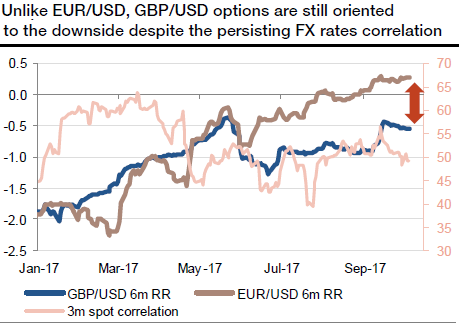

Unlike EURUSD options, cable options are still pricing more implied volatility in the event of a lower currency (refer above graph). The risk reversal curve remains fully skewed to the downside, especially for longer maturities. These diverging expectations are especially striking in a context whereby there is a strong correlation between EURUSD and GBPUSD.

GBP OTC hedging sentiments are intensifying due to the above Brexit negotiations. Is this the beginning of the final phase bearish trend of the British currency? Not yet, but the risks are rising.

Considering above OTC market reasoning and fundamental factors we think upside risks are on the cards, as result we reckon deploying ATM call option with delta being at around +0.51 in hedging strategies are worthwhile.

We fundamentally view asymmetric odds in favor of the topside case, and this highlights the current cheapness of GBPUSD OTM calls.

The execution: Buy GBPUSD 6m/2m/1m bullish seagull strikes 1.27/1.38/1.34 (Spot ref: 1.3113).

This structure has almost no theta between the current spot and the 1.40 region during the four first months. As it is a very low theta means almost no convexity, it, therefore, behaves like a spot trade during this period in this region.

The payoff, however, provides protection against a spot spiking above 1.27.

Risks: Unlimited above 1.38, the structure involves a 2m/1m OTM short call strikes. So investors face unlimited upside risk if GBPUSD trades above that level in 2m months.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand