FxWirePro: CADJPY Daily Outlook

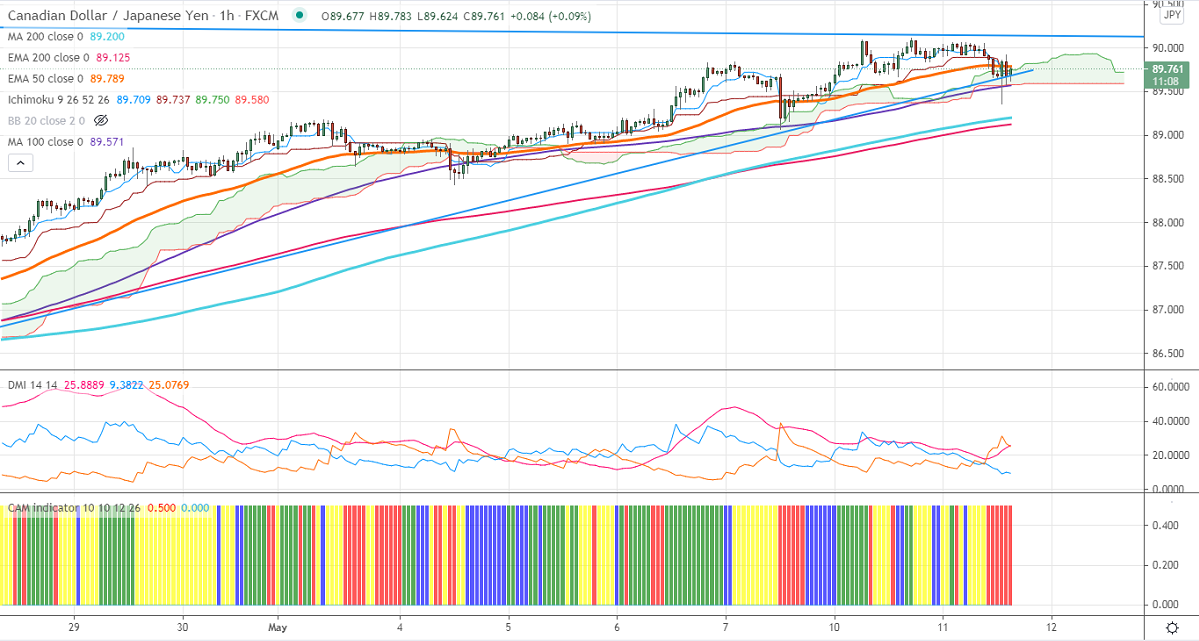

Ichimoku Analysis (1-hour chart)

Tenken-Sen- 89.70

Kijun-Sen- 89.739

CADJPY has halted its three weeks of the bearish trend and lost more than 75 pips. The pair was one of the best performers this year and surged more than 10% on broad-based Canadian dollar buying. The Canadian dollar is trading higher as the commodity market remains strong. The copper prices hit an all-time high on economic recovery after the corona pandemic. USDCAD hits a multi-year low on broad-based US dollar selling. USDJPY is trading weak after a minor pullback to 109.05. Any violation below 108.20 confirms trend continuation. The short-term trend of CADJPY is bullish as long as support 89 holds.

On the higher side, the pair is facing resistance at 90.15. Any indicative surge past targets 90.56/91.58.

The significant support is at 89, any decline below that level will drag the pair down to 88/87.60. Significant trend continuation only below 85. A dip till 83/80 is possible.

It is good to sell on rallies around 90 with SL around 90.51 for the TP of 88.