The minutes of the last FOMC meeting did not provide any ground-breaking insights as regards the central banks' future approach. By and large, the FOMC members agree that further gradual rate hikes are opportune. There is uncertainty as to the speed and amount of further interest rate hikes. However, it is not just the US central bank that is facing this dilemma. There are very different views amongst market participants too in this regard.

On the flip side, the loonie has constantly been gaining despite today’s minor price drops amid July hike hopes that still stay alive. The unexpected strength of the Canadian economy in April, continuing the strong monthly GDP prints for February and March, has provided further support for an increase in BoC hike expectations at its 11th July meeting. With the market now pricing nearly 90% probability of a 25bp hike at that meeting, we believe risk-reward is now shifting to a move higher in USDCAD.

Elsewhere, At least the trade tensions have clearly escalated, as the US has imposed 25% tariffs on the first batch of Chinese products worth USD34bn from today.

Consequently, Brent crude, the global oil benchmark, surged 0.15% to $78.37 a barrel on London’s ICE Futures exchange. On the NYME, WTI futures were trading up 0.54% at $74.54 a barrel.

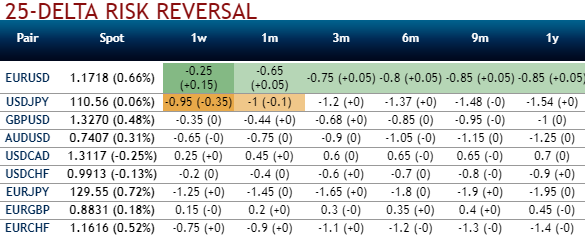

Before we move onto the core part of the strategies, let’s just glance through the risk reversals of USDCAD across all tenors are showing bullish hedging bids. While the IV skews have also been positive for OTM calls and puts of 1m tenor that signifies both bullish and bearish amid above stated fundamental factors.

Accordingly, we uphold staying short USDCAD through a low-cost RKO: The USDCAD put RKO was originally conceived as a low-cost option to gain exposure to what seemed like a decent chance of a near-term breakthrough in NAFTA negotiations.

Now what seems most likely is that the option will expire worthless, particularly after the latest developments in the US Trade policy which seemingly swung the tone of NAFTA negotiations back to an antagonistic one where Trump has once again publically hinted about the possibility of pulling out.

Buy 2m 1.29 USDCAD put, RKO 1.25 for 14bp, spot reference: 1.3133.

Buy 3M USDCAD 25D call vs sell USDRUB 25D call, in 1.8:1 vega. Oil hedged EM – DM vol compression RV with NAFTA edge. Courtesy: Commerzbank

Currency Strength Index: FxWirePro's hourly CAD spot index is flashing at -29 levels (which is bearish), while hourly USD spot index was at -128 (bearish) while articulating at (12:38 GMT). For more details on the index, please refer below weblink:

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios