Canada's trade deficit increased to its largest in 4 months CAD 1.9 billion in February of 2016 from a downwardly revised CAD 0.63 billion gap in January and above market expectations of CAD 0.9 billion.

Exports dropped to 5.4% and imports declined at a slower 2.6%.

CADJPY spot is struggling to approach even minor resistance at 84.348 levels, as a result CFDs of this pair slightly have been drifting down.

Hedging Framework:

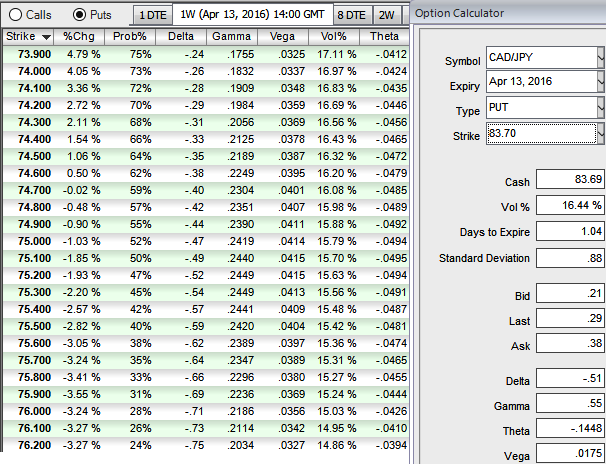

The implied volatility of 1W CADJPY ATM contracts 16.44%.

3-Way Options straddle versus Call

Spread ratio: (Long 1: Long 1: Short 1)

Rationale: Since ATM IVs are trading 16.44%, shorting expensive OTM or ATM calls during bearish situations with shorter expiries would likely result in positive cash flow on expiration. As a result, we capitalize on such beneficial instruments and deploy in our strategy.

How to execute:

Go long in CADJPY 1M at the money delta put, Go long 1M at the money delta call and simultaneously, Short 1M (1%) out of the money call with positive theta.

If one is bearish to very bearish, then one can even eye on writing ATM or ITM calls as well as an alternative to shorting the underlying spot FX.