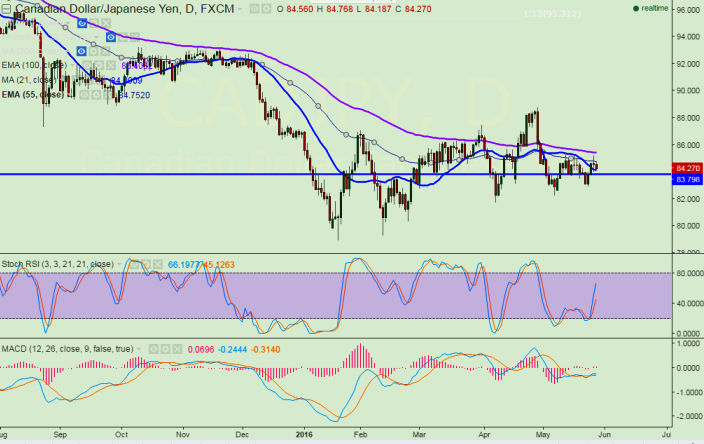

- Major resistance- 85.50 (100 day EMA)

- Major Support – 83.60

- CAD/JPY has made a high of 85.17 yesterday and started to decline drastically from that level. The pair opened around 84.56 today morning and slightly jumped till 84.76. It is currently trading around 84.23.

- The minor resistance for the day is at 84.76 (55 day EMA) and any break above 84.76 will take the pair till 85.20/85.50.

- It should break above 85.50 for further bullishness.

- On the lower side major support is around 83.60 and any break below targets 82.90/82.25 level.

It is good to sell on rallies around 84.50-84.60 with SL around 85.50 for the TP of 83.60/82.90