On the supply side, we see limited scope for further supply disruptions this year. Double-digit price appreciations in some of the metals in the last month and a half also represent signs of potentially larger production volumes in 3Q, especially in silver, nickel, copper, and zinc.

These are the fundamentals, but they are only part of the picture. As a US dollar-denominated commodity, metals are obviously highly influenced by the US dollar.

The dollar has likely backed around 3% to industrial metals gains thus far in 3Q, while the ferrous rally has contributed another 2%.

Higher global growth in the first half did not come with higher inflation and faster monetary tightening. JPM’s house view of inflation normalization and rising real rates keep us neutral gold at this point.

Turning to silver more specifically, investor demand on the COMEX has primarily driven silver prices higher so far in 2017 with ETF demand and physical investment appearing lethargic from the 1Q data we have.

OTC updates:

Prices in bullion markets have surged, gold gained to hit 2017 highs from the lows of $1122.81 and silver from the lows of $14.39 to the current $17.557 levels.

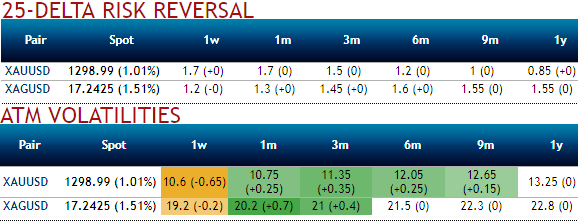

While hedging interests for upside risks are mounting as you could easily make out from the positive risk reversal flashes along with the corresponding noticeable spike in IVs of 1-3m tenors.

The implied volatilities of XAGUSD (silver) ATM contracts are spiking crazily higher towards 20% and 21% of 1m and 3m tenors respectively, while delta risk reversals of ATM contracts are indicating bullish risks.

Accordingly, the spot price in technical trend approaching near 3-months highs, surging at 17.521 levels (i.e. above 7 & 21 EMAs) with all bullish technical sentiments (refer below write up for more reading on technicals), it seems the major trend has been drifting in consolidation phase we foresee equal opportunity for both bulls and bears in this major trend but with little bullish bias, hence, we foresee writing opportunity in OTM puts.

Hedging Framework:

3-Way Options straddle versus OTM put

Spread ratio: (Long 1: Long 1: Short 1)

How to execute:

At spot reference: 17.521 an ounce, capitalizing on spiking IVs which is good news for option holder, initiate long in XAGUSD 2M at the money +0.51 delta call, go long 2M at the money -0.49 delta put and simultaneously, short 2w (1%) out of the money put with positive theta.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different