The dual major FX market themes are conceded in the recent past, the sensitivity and focus on reassessing central bank policy, and the ongoing vulnerability of the dollar.

For Swiss Franc, no particular thing is found new with SNB rhetoric. Please be noted the market’s inclination to respond by shifting CHF into the USD and JPY bucket of currencies which will be in snail’s pace or lagged to normalize policy going forward, but the moves have been particularly extreme.

JP Morgan’s analysts have refrained from becoming too dovish SNB for various macro reasons. As such, we would not chase CHF weakness, and continue to prefer to fund EUR longs through USD and JPY. Meanwhile, we continue exploring drivers of broad-dollar weakness this week, examining potential structural drivers that might drive more long-term fair value mean reversion.

Specifically, we note that for reserve managers, earlier conditions that induced a 4% increase in USD allocation in FX reserves, are now fading, and the earlier decade-plus trend of diversification away from the dollar will likely resume.

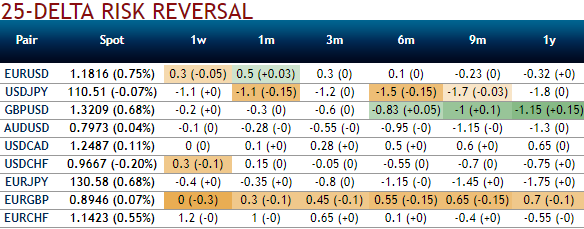

Buying volatility on top side only The EURUSD skew is now positive up to the 3m expiry, but longer tenors should gradually adjust as well. In the current configuration, the options market is still pricing the highest extra downside vol on the 1y tenor (the 1y RR is trading at -0.32, whereas the 3m is at +0.3).

Powerful beta-forces of Euro strength and dollar weakness continued to leave their imprint on FX vol surfaces for another week. Gamma continued to outperform, led this time around by the outsized 2.5% w/w move in USDCHF, vol curves remained under flattening pressure and the recent trend of risk-reversals reshaping away from USD calls in favor USD puts stayed intact following a dovish-leaning FOMC statement (refer above table).

Investors can, therefore, consider going long an EURUSD 1y corridor volatility swap, buying realized volatility only on the top side. The corridor restriction substantially lowers the traded volatility while implementing our bullish and volatile euro view.

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data