Hedging Frameworks: Butterfly Spreads (CADJPY)

The prime time for Yen tightening its gains back again but slight chances of bounces cannot be ruled out, but some dramatic differences in prices on either direction is possible with slight bearish bias only, thus we advise to hedge this pair with below recommendations.

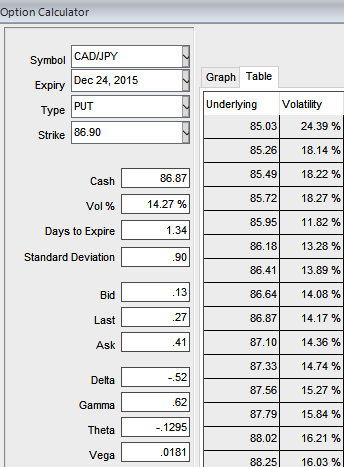

On the contrary we believe CAD's loses are majorly due to crude's weakness. Currently the pair is trading at 86.858 with volatility of ATM contracts marginally inching higher (at 14.27%).

Hence, the recommendation on buying 1w (-1%) OTM -0.25 delta put while simultaneously shorting 2 lots of ATM puts with 2D expiries and buy 1W (1%) ITM -0.72 delta put. This strategy is structured for a larger probability of earning a smaller but certain profit.

The highest return for this strategy is achievable when the pair at expiration is equal to the strike price at which at the money options are sold. At this price, all the options expire worthless and the options trader gets to keep the entire net credit received when entering the trade as profit.

Key Economic Fundamentals: Last week's Japanese sharp jump in GDP q/q basis suggests that Japan making attempts of recovery (reported +0.3% from previous -0.2%).

We saw a steep jump in IP m/m from -0.3% to 0.6%. Tankan's both manufacturing and Non-manufacturing also posts upbeat numbers 12 and 25 respectively which were beyond forecasts at 11 and 23 respectively.

Data for the focus today is that Canadian monthly GDP followed by retail sales and Japanese side monetary policy minutes.

FxWirePro: Butterfly spreads to monitor CAD/JPY’s intermediate swings ahead of Canadian GDP and retail sales

Wednesday, December 23, 2015 7:02 AM UTC

Editor's Picks

- Market Data

Most Popular