Bearish scenario (USDJPY upto 100) if:

1) The global investors’ risk aversion heightens significantly,

2) The weak US economy dampens hopes for Fed hikes,

3) U.S. administration talks down USDJPY aggressively.

Bullish scenario (USDJPY upto 125) if:

1) The strong US growth leads more aggressive Fed hikes,

2) Japanese fiscal policy becomes more expansionary, resulting in higher Japan’s inflation expectations.

One important assumption of our bearishness on USDJPY is that a correlation between the pair and U.S.-Japan yield spread collapses with heightening concerns on political risks. Although it was the case early this year, the correlation has strengthened again as the U.S.-Japan summit and Trump’s speech to Congress passed without any troubles.

As a more harmonic U.S.-Japan relationship and a more aggressive Fed stance would mitigate downside risks to USDJPY to some extent.

As the new profile suggests, however, we think factors mentioned above would not be influential enough to get USDJPY on a solid upward path heading to 120 or even higher, and still, expect it to track a modest downward trend in the medium-term.

Regarding politics, recent developments suggest that the U.S. administration continues to see their trade deficit as a problem and to seek redress the trade imbalance through bilateral negotiations. There are many political events in 2H of March and next month. The market focus will likely shift to politics after the FOMC and concerns on the U.S. protectionism will weigh on USD again, as seen in early this year.

OTC updates and hedging frameworks:

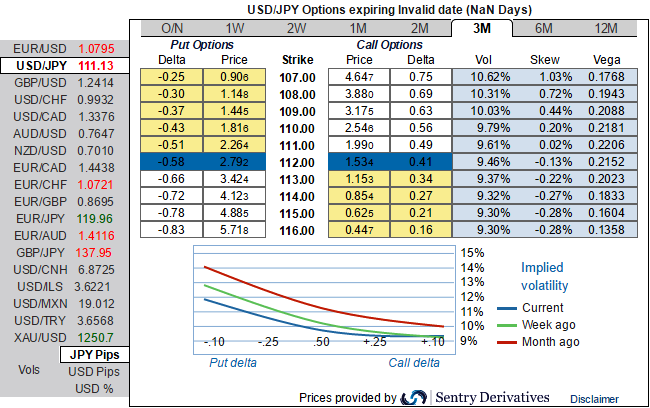

At spot reference: 111.099, USDJPY 3m risk reversals and positively skewed IVs are indicating hedging interests for downside risks still remain intact (while articulating).

While 1m IVs have collapsed 67 points to 9.26% and 3m IVs are spiking at around 9.67%.

The positively skewed IVs of 3m tenors are indicating the hedgers’ interest in OTM put strikes.

With bearish-neutral risk reversal, we wouldn't be surprised even if the underlying spot FX evidences the interim spikes, bears likely to drag again towards 110 levels sooner or later.

Hence, we deploy ITM puts with longer tenors in our option strategy as the delta risk reversals favor bearish targets, hence in order to keep the risks on either side on the check we reckon diagonal debit put spreads are best suitable as the IVs and premiums are reasonable considering daily swings on technical charts.

So, here goes the strategy, Debit Put Spread = Go long 3m (1%) ITM -0.49 delta Put + Short 1m (1.5%) OTM Put with lower Strike Price with net delta should be at around -0.40.

For a net debit, bear put spread reduces the cost of trade by the premium collected (on the shorts of OTM put) and keeps option trader to participate in downward moves and any upswings in abrupt.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand