Ahead of the key US policy rate decision next week, the August reading of CPI inflation is due today. Although this is not the Fed’s preferred inflation measure, it nevertheless provides a first indication in how inflation evolved last month.

More generally, we expect headline inflation to rise gradually over time, but it is sufficiently contained for now to enable the Fed to put off a rate hike until December. The data indicated that the Fed is likely to leave interest rates unchanged at its next meeting, which is scheduled for September 20-21.

The risk-on sentiment and hunt for yield that prevailed in the past few months, benefiting emerging-market assets, was based on a belief that central banks were going to provide more stimulus as the Fed stands pat.

Since the bears in Gold have wiped off buying interest, for now, the price has been tumbling consecutively from the last couple of days and on the Comex division of the NYME, gold futures for December delivery were steady at $1,318.50.

Hedging Framework:

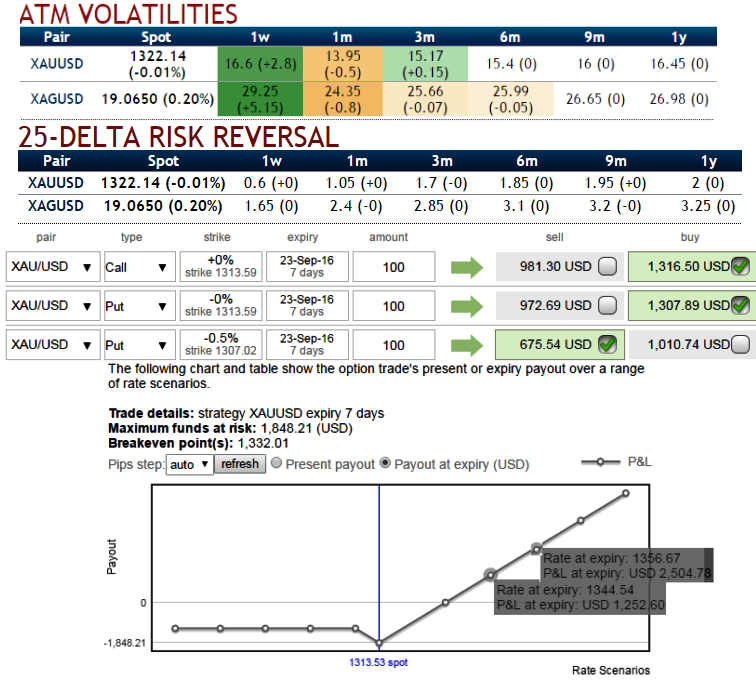

The implied volatility of 1W XAU/USD ATM contracts - 16.6% and 13.95% for 1m tenors.

While, risk reversals are still signalling upside risks, considering above fundamental developments in bullion markets we think the opportunity lies in writing an OTM put while formulating below strategy for gold's fluctuation at this juncture.

3-Way Options straddle versus Put

Spread ratio: (Long 1: Long 1: Short 1)

Rationale: Bidding short term risk reversals with writing 1W OTM put contracts,

As stated above, since Fed in next week’s monetary policy likely to maintain status quo in its funds rate, bullion market may gain momentum on safe-haven demand sentiment would be strengthened.

So, shorting expensive puts with shorter expiries would reduce the cost of ATM straddles.

How to execute:

Go long in XAU/USD 2M At the money delta put, long in 4M at the money delta call and simultaneously, Short 1M (1%) out of the money put with positive theta.

Please be noted that the tenors chosen in the diagram are just for demonstration purpose only, use appropriate tenors as stated above.

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty