Brexit risks are crystallizing around Jun/Sept: steep GBP skews provide attractive put spread hedges.

The potential Brexit risk premium have begun to be priced into options, OTC markets are evident to display this scenario, OTM puts are getting overpriced. The risk would aggravate once it is clearly scheduled. The likelihood of the event favor a 1Y bearish risk-reversal in cable (temporal Fed-BoE policy divergence could weaken cable before the political risk premium kicks-in mid-year).

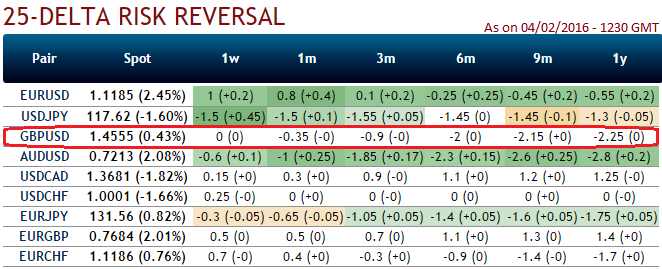

One can very well empathize this from the delta risk reversal nutshell, the highest negative hedging set ups among G7 currency spaces. As it showed the highest negative values, it relatively indicates OTM puts are more expensive than OTM calls (downside protection is relatively more expensive).

Currency crosses wise the regressions for cable and EUR/USD yield unevenly comparable approximations for the risk premium at between 3-4%. This is broadly the risk-neutral, probability-weighted average of the binary referendum scenarios if we assume a subjective 30-40% probability of Brexit and a 10% drop in the currency under that scenario, and so from this perspective the major GBP pairs seem to be fairly valued.

But this inference overlooks the fact that risk-averse rather than risk-neutral behavior is likely to outweigh in the real scenarios, i.e. participants are likely to attach a greater weight to potential losses than gains and so should require a larger risk-premium to hold GBP ahead of the EU referendum than if they were risk-neutral and indifferent between gains and losses.

While this section has focused on the threat to GBP from an increase in the Brexit risk premium, we note this is not the only source of potential downward pressure on GBP in coming months. It is certainly not the view of our economists, but fair-value for GBP itself could be challenged if the UK curve not only cancelled the rate hiking cycle, but began to contemplate rate cuts instead. Full pass-through from an unexpected 25bp BoE rate cut would entail a 2-2.5% drop in GBP TWI.

The major jeopardies to the trade are:

The referendum is ultimately deferred until 2017.

There is less Fed/more BoE tightening. But the Brexit risk could also be hedged via structures that are implicitly long of GBP correlations.

GBP/USD puts with RKOs in EUR/GBP or dual at-expiry digitals (GBP/USD down, EUR/GBP up), albeit the cost savings compared to vanilla puts is limited as the term structure of forward GBP correlations is already relatively steep.

FxWirePro: Brexit risk premium priced into FX option market (1Y GBP put options have become expensive)

Friday, February 5, 2016 8:16 AM UTC

Editor's Picks

- Market Data

Most Popular

2

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?