The leading cryptocurrency (BTCUSD) by market value, has been puzzling with its topsy-turvy swings, and currently trading at $3,979 levels, have spiked over 24% from the year’s low of $3,122 seen in December. This positive trend has spurred hopes that the sell-off from the late 2017 record high of $20,000 is over.

The technical charts indicate that Bitcoin needs to climb at least another $350 to confirm a long-term bullish reversal.

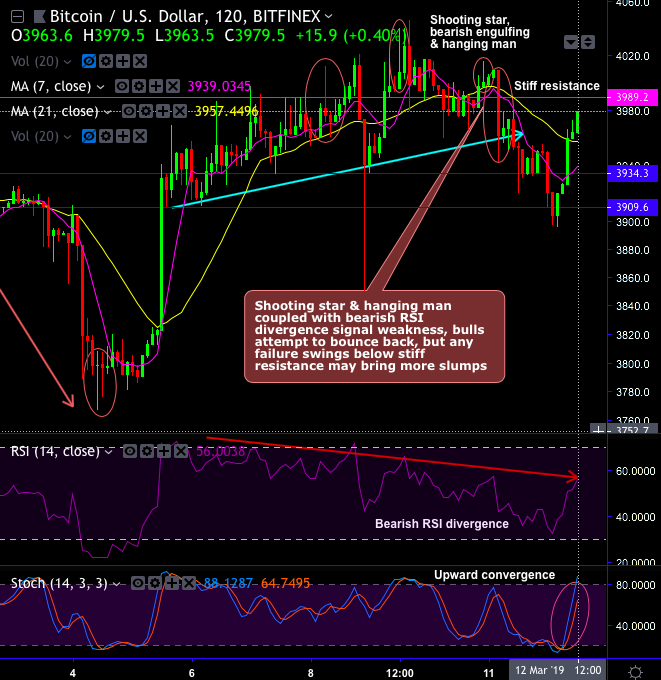

RSI bearish divergence on BTCUSD has signaled momentary weakness, ever since then the last month’s rallies seem to have been exhausted and bears resume of late.

In addition to that, the pair also form shooting star, bearish engulfing and the hanging man at peaks of rallies (refer circular areas on 2H charts).

The minor resistance levels are observed at near $3,989 - $4,100 and the major resistance near $4,620 (i.e. 7-EMA levels).

The minor support areas are observed near $3,934 and $ 3,909 levels.

Please be noted that the weakness, for now, is intensified upon bearish stochastic crossover, and RSI divergence in the medium and short-term trend. While the trend indicators (DMA & MACD) also show bearish crossovers that indicate downswings to prolong further.

Intermediate trend breaches below range & retraces more than 78.6% Fibos with bearish EMA & MACD crossovers, bearish pressures imminent as the current price well below EMAs.

Overall, we could foresee the minor hiccups in the bitcoin price trend, but the major trend has been attempting to consolidate. On hedging grounds, it is wise to stay long hedge in CME BTC futures of mid-month tenors rather than holding underlying bitcoins.

This Wednesday the latest round of CBOE XBT (XBTH19) futures expires. These futures contracts need to be settled on a predefined date, based on contractual terms. All CBOE contracts will have to be traded, or settled, before this date. There is generally a dip in the trading volume of futures around expiration dates, that coincides with a rise in volatility and potential short/long squeezing.

XBT futures are cash-settled contracts based on the Gemini's auction price for bitcoin, denominated in U.S. dollars. Gemini Trust Company, LLC (Gemini) is a digital asset exchange and custodian founded in 2014 that allows customers to buy, sell, and store digital assets such as bitcoin, and is subject to fiduciary obligations, capital reserve requirements, and banking compliance standards of the New York State Department of Financial Services. Courtesy: Tradingview.com, CME

Currency Strength Index: FxWirePro's hourly BTC spot index is flashing -32 (which is mildly bearish), while hourly USD spot index was at -102 levels (highly bearish) at 13:15 GMT.

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One