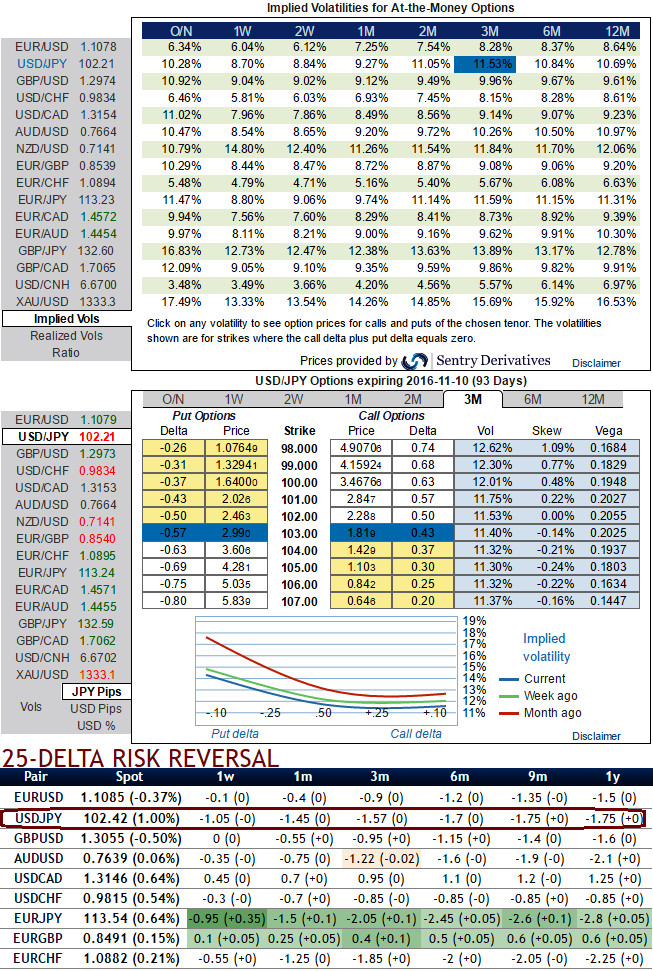

Volatility shocks and the passage of time have opposite effects on the value of a vanilla option (see ATM strikes on USDJPY options). When it can benefit from more volatility (long vega and gamma on OTM put strikes), time has a negative impact every day (short theta).

Yen IVs: Live September meeting should keep 2M vol supported; while yen 1-3m risk-reversals still a better sale as Fed considers global slowdown risks and Brexit settlements which is why the US central bank keeps deferring rate hikes atleast until the end of 2016 or by Q1 of 2017.

Please be noted that the 1m IV skews are more biased towards OTM put strikes, significant changes can indicate a change in market expectations for the future direction in the underlying forex spot rate and these risk reversals evidences the difference in volatility, and therefore price, between puts and calls on the most liquid out-of-the-money (OTM) options quoted on the OTC market.

This loss is the greatest when the spot is close to the option strike, and accelerates as maturity approaches (convergence towards intrinsic value, i.e. the terminal payoff). Conversely, a short volatility strategy gains value with time.

Therefore, long vol directional investors are struggling against the clock while short vol investors are not pressed by the countdown to expiry. The former ‘buy’ market volatility while the latter ‘buy’ time on the market. As a result, long vol directional investors generally are more interested in contemplating an early unwind than short vol investors.

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics