RBNZ is due to release its monetary policy statement tomorrow, wherein it announces OCR rates which is likely to remain on hold. This is going to be the last monetary policy proclamation for the governor, Wheeler in this tenure who has served since September 2012.

The RBNZ’s OCR Review on Thursday morning (9 am NZT) is widely expected to keep the OCR on hold at 1.75%. There should be little change in guidance, given the interim nature of OCR Reviews (the Monetary Policy Statement in November includes a comprehensive update of its economic forecasts).

On the flip side, Fed Chair Yellen said the Fed should be wary of moving too gradually and that it is imprudent to keep the policy on hold until inflation reaches the 2% target. However she spent more time discussing downside risks to inflation, leaving markets with a mixed tone overall. Bostic was comfortable with a December hike. The fx moves were purely driven by the sentiment around the greenback, as the Asian traders digested Yellen’s hawkish remarks and Trump’s tax overhaul plan news.

We expect NZD to fall over the next 12 months, as growth will likely continue to underperform the RBNZ’s lofty forecasts (refer above chart), housing slows (refer above chart), and as tight financial conditions restrain any requirement for OCR hikes, allowing rate compression vs USD.

Hedging framework:

OTC Outlook and Option Trade Recommendations:

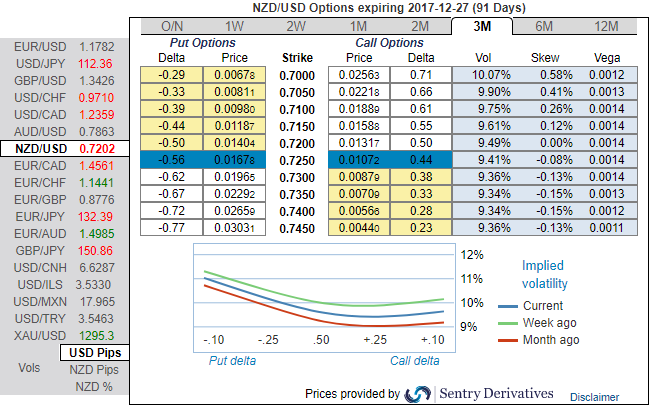

All the factors stated above seem to be discounted in FX options market, please glance through nutshell evidencing IV skews that signify hedger’s bearish interests in next 3-months timeframe. Positively skewed IVs of this tenor signal underlying spot FX is expected to be either edgy with sideways swings or lowering southwards as the skews have been well balanced flashing positive numbers on both OTM and ITM strikes. Accordingly, we’ve recommended credit put spreads in order to participate both upswings in consolidation phase and anticipated downside risks.

By now, writing 1m (1%) in the money put would have fetched us handsome yields snapping rallies upto 0.7558 levels in form of initial option premiums received. You could easily make out short legs on ITM puts of narrowed expiries are going worthless as anticipated. For now, we uphold longs in 3m at the money put, the structure could be constructed at the net credit.

Upon the mounting bearish risk sentiments are observed as you could see the positively skewed IVs in OTM put strikes of 1m tenors (refer positive IV skews indicate the strikes towards 0.70 which is our forecasts).

The combination of IV 1-3m skews suggested credit put spreads that has favoured to arrest ongoing upswings in short run and bearish risks are to be taken care by 3m ATM longs.

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data