Over the weekend, it has become clear that the UK has been thrown into political chaos due to the relatively close 52-48% referendum outcome.

Given concerns on limits of the policy arsenal at the BoJ and rising euro-centric risks, we recommend initiating short EURJPY positions for medium term hedging.

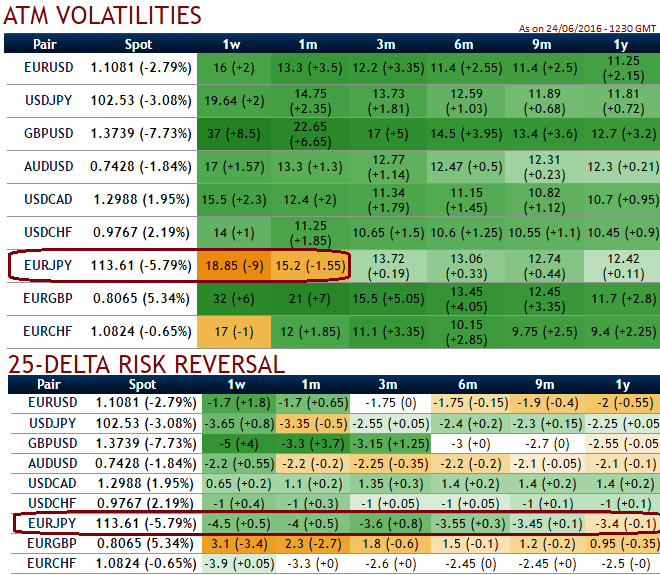

Although the delta risk reversals have still remain in bearish interests, the positive flashes signify the traction for short-term sentiments for slight bounce back but the hedging sentiments for downside risks in a medium run is still intact.

While current IVs of ATM contracts are shrinking away gradually after risky event Brexit event and central bank policy season in Japan, it is likely to perceive a tad below 19% in 1w expiries that would divulge pair’s gain which in turn leads to an opportunity for short term option writers (see 1w-1m ATM IVs).

Capitalizing on interim upswings in EURJPY, shorts have been favored by acknowledging the implied volatility fading away in of Euro crosses (see nutshell).

Technically, our bearish stances in medium-term for EURJPY are again encouraged by breach below 61.8% Fibonacci retracements. Lack of upside traction signified by both leading and lagging indicators. In addition to that on monthly plotting, an inverted saucer pattern is formed which is bearish in nature.

Contemplating above OTC and technical reasoning, risk reversal positioning and the implied volatility of ATM contracts for near month expiries of this the pair is would be between 15-18%, we eye on unloading with fresh longs and deploy shorts, but more number of longs comprising both ATM and OTM instruments ITM shorts in short term would optimise the strategy.

Having mentioned that, don’t forget that more downside risks are still on the cards in the medium run, as a result, deploying more ATM delta instruments (as per risk reversal indication in the long run) would be used to measure the value of an option as the market moves. This is useful to monitor directional risk so you may know how much your option’s value will increase or diminish as the underlying spot FX market moves.

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data