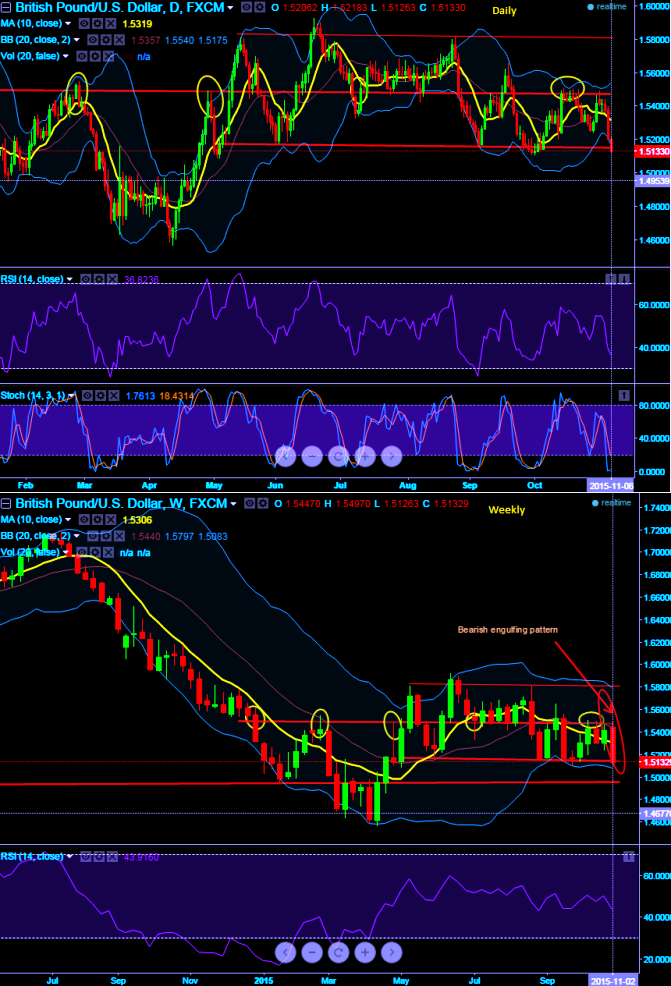

The pair is likely to evidence bearish swings, while plotting both daily and weekly charts we've come across serious bearish indications.

Intraday sentiments are seriously bearish as the pair is lingering around strong support zone at 1.5170 levels. These levels have been holding since April, if it breaks below would certainly expose to 1.4915 levels.

On weekly, the occurrence of bearish engulfing pattern is almost certain ahead of NFP data during U.S session (wait until data release for candle to complete its formation). USD has been inching fresh 3 month highs against the other major currencies today as traders stare at the release of U.S. employment claims later in the day amid growing expectations for a December rate hike by the Fed.

Prevailing prices have slid below 10DMA both on weekly and daily. This signals the pair to drag down further, more slumps on cards in medium term.

Leading oscillators (RSI and stochastic) indicate downward convergence with steep price slumps on both weekly and daily charts. So, selling pressures are bolstering as bears holding strength.

While the current spot FX is sliding below lagging indicator (10DMA) on four hourly charts that signifies these price dips to prevail for some more time.

On speculative mindset, at spot FX levels of 1.5130, it is good to buy -0.50 delta binary put options on every price spikes for minimum targets of 45-55 pips with stop loss of 30-35 pips on upper side.

FxWirePro: Bearish engulfing most likely on GBP/USD, sliding below trendline support ahead of NFP

Friday, November 6, 2015 11:44 AM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings