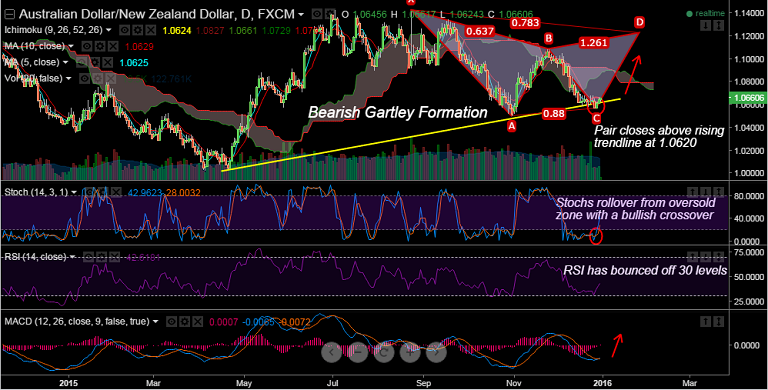

We see a Bearish Gartley formation on AUD/NZD charts. The pair dipped below strong trendline support on Dec 28th, but bears struggled to take the pair lower.

- AUD/NZD bounced back from 1.0567 levels, has edged above the trendline resistance at 1.0620 and is currently trading at 1.0662.

- A break above 1.0679/81 resistance (highs Dec 17 & 24) will give more confidence, pair could see 1.1086 levels (Nov 24, 25 highs).

- Stochs have rolled-over from oversold territory with a bullish crossover, RSI on dailies has also bounced-off 30 levels and is currently at 43 and points north.

- We also see a positive MACD line crossover on signal line, the histogram back into positive territory.

- We would expect completion of the Bearish Gartley , so it is good to go long on dips around 1.0645, SL: 1.0550, TP: 1.1080 levels.

Resistance Levels:

R1: 1.0667 (Dec 30 highs)

R2: 1.0679/81 resistance (highs Dec 17 & 24)

R3: 1.0741 (21-Day MA)

Support Levels:

S1: 1.0629 (10-DMA)

S2: 1.0625 (5-DMA)

S3: 1.0606 (Dec 30 lows)