Bearish GBPJPY Scenarios:

1) The UK-EU fail to agree on a trade deal and the UK exits the transition period on

WTO terms (GBPUSD to 1.20, potentially 1.10).

2) The economic lockdown is extended into June, delaying economic recovery well into 3Q.

3) UK fiscal deficit extends toward 15%.

4) Pandemic Covid-19 apprehensions re-intensify significantly, leading to multiple waves

of infections or Japan-specific rises in case numbers;

5) Assessments for the prospect of a V- shaped global growth recovery are significantly tested;

6) Trade tensions between the US and China re-intensify with negative spill-overs to Japan’s supply chain.

Bullish GBPJPY Scenarios:

1) Johnson backtracks and extends the transition period into 2021.

2) A more rapid transition to COVID-19 recovery.

3) Safe haven inflows on a fully-fledged EUR debt crisis.

4) The outlook for the global economy recovers more sharply than expected and risk sentiment firms;

5) Momentum in JPY selling flows related to outward portfolio investments and FDI repeats on a similar exceptionally large scale as seen in 1Q’20.

On data front, UK PMIs (both manufacturing & services) are to be announced on this Thursday, the IHS Markit/CIPS UK Manufacturing PMI was revised lower to 47.8 in March 2020 from a preliminary estimate of 48.0 and below February's final reading of 51.7. While the services PMI was revised lower to 34.5 in March 2020 from a preliminary estimate of 35.7, signalling the fastest downturn in service sector activity. The consensus for now is further declined to 42.5 and 29.6 levels respectively, these are the leading indicator of economic health as the various relevant businesses react swiftly to the market circumstances amid the pandemic Covid -19 crisis.

On the flip side, Bank of Japan is scheduled for their monetary policy on 28th of this month. To date, the BoJ noted that pressures on liquidity faced by Japanese borrowers had largely been limited to small and micro services firms in hospitality and retail. And average interest rates on new loans had remained around historically low levels.

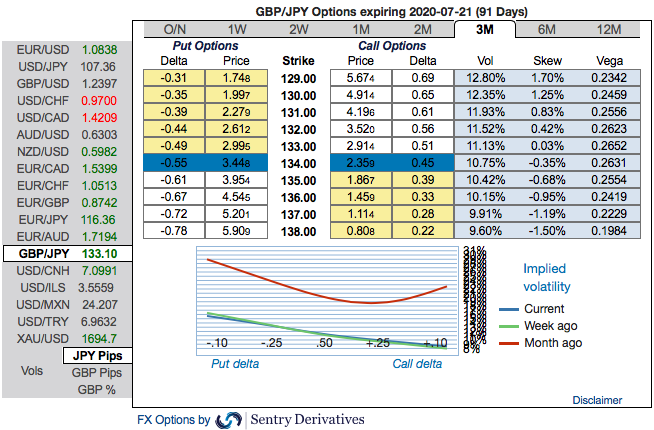

OTC outlook and Hedging Strategy: The implied volatility of this pair that display the highest number among entire G7 FX universe.

While the positively skewed IVs of 3m tenors signify the hedgers’ interests to bid OTM put strikes up to 129 levels (refer above nutshell).

Accordingly, put ratio back spreads (PRBS) are advocated on the hedging grounds. Both the speculators and hedgers who are interested in bearish risks are advised to capitalize on current abrupt and momentary price rallies and bidding theta shorts in short run, on the flip side, 3m skews to optimally utilize delta longs.

The execution: At spot reference: 134.250 levels, capitalizing on any minor upswings and major downtrend, we advocated shorting 2m (1%) OTM put option (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, go long in 2 lots of delta long in 2m ATM -0.49 delta put options.

The position is a spread with limited loss potential, but varying profit potential. The degree of profit relies on the strength and rapidity of price movement. The position uses long and short puts in a ratio, such as 2:1 or 3:2, to maximize returns. Courtesy: Sentry & JPM

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts